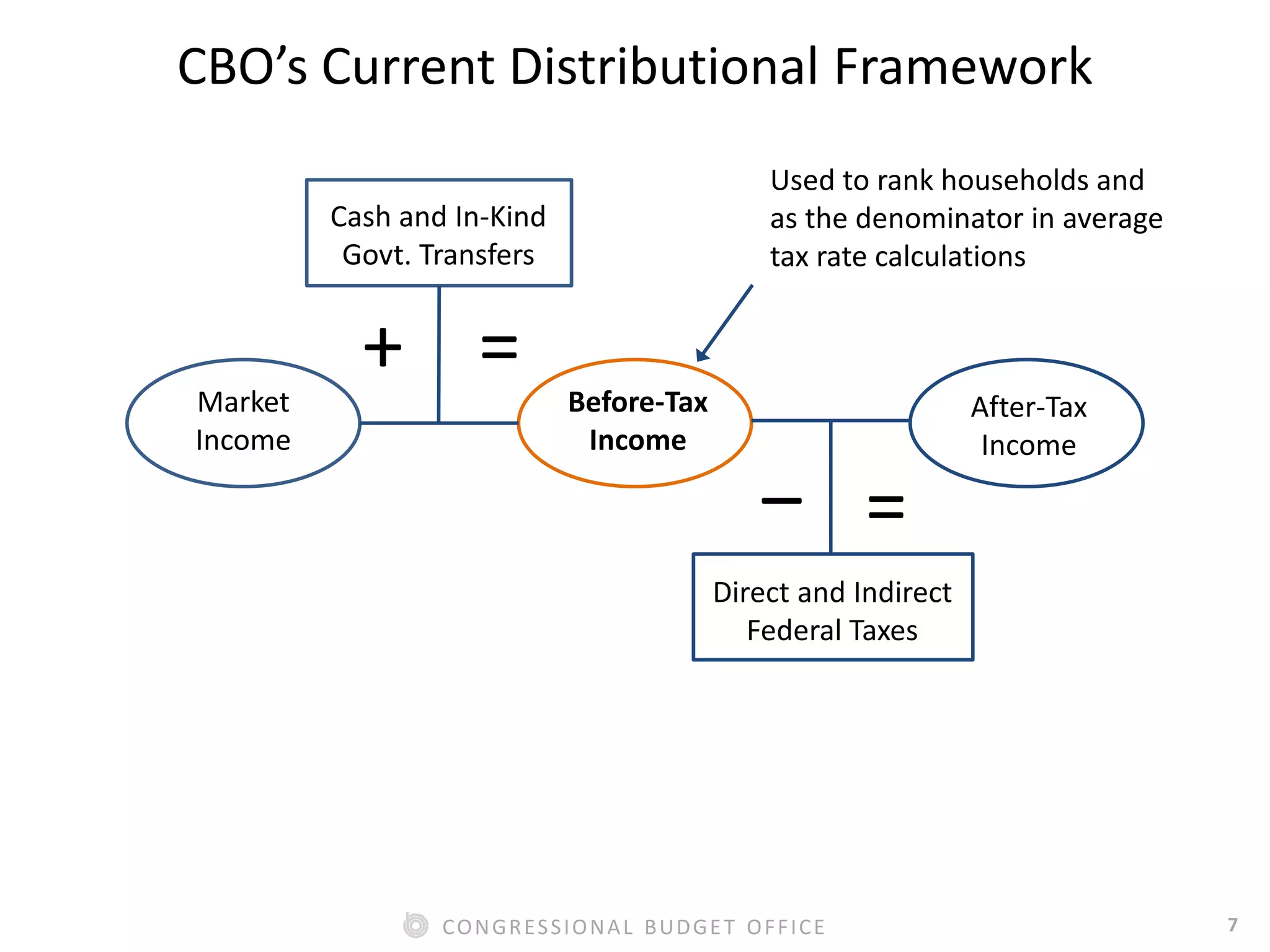

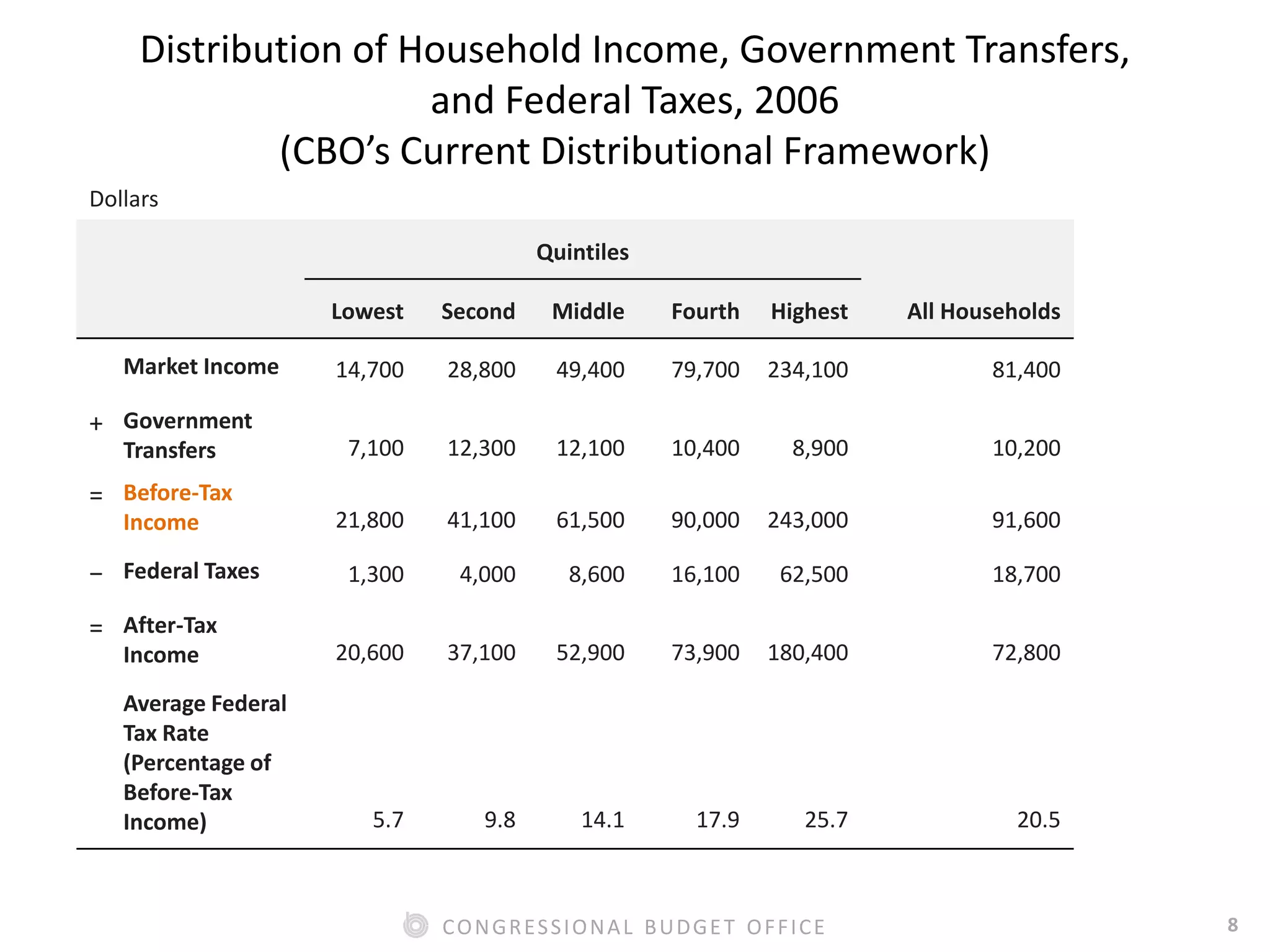

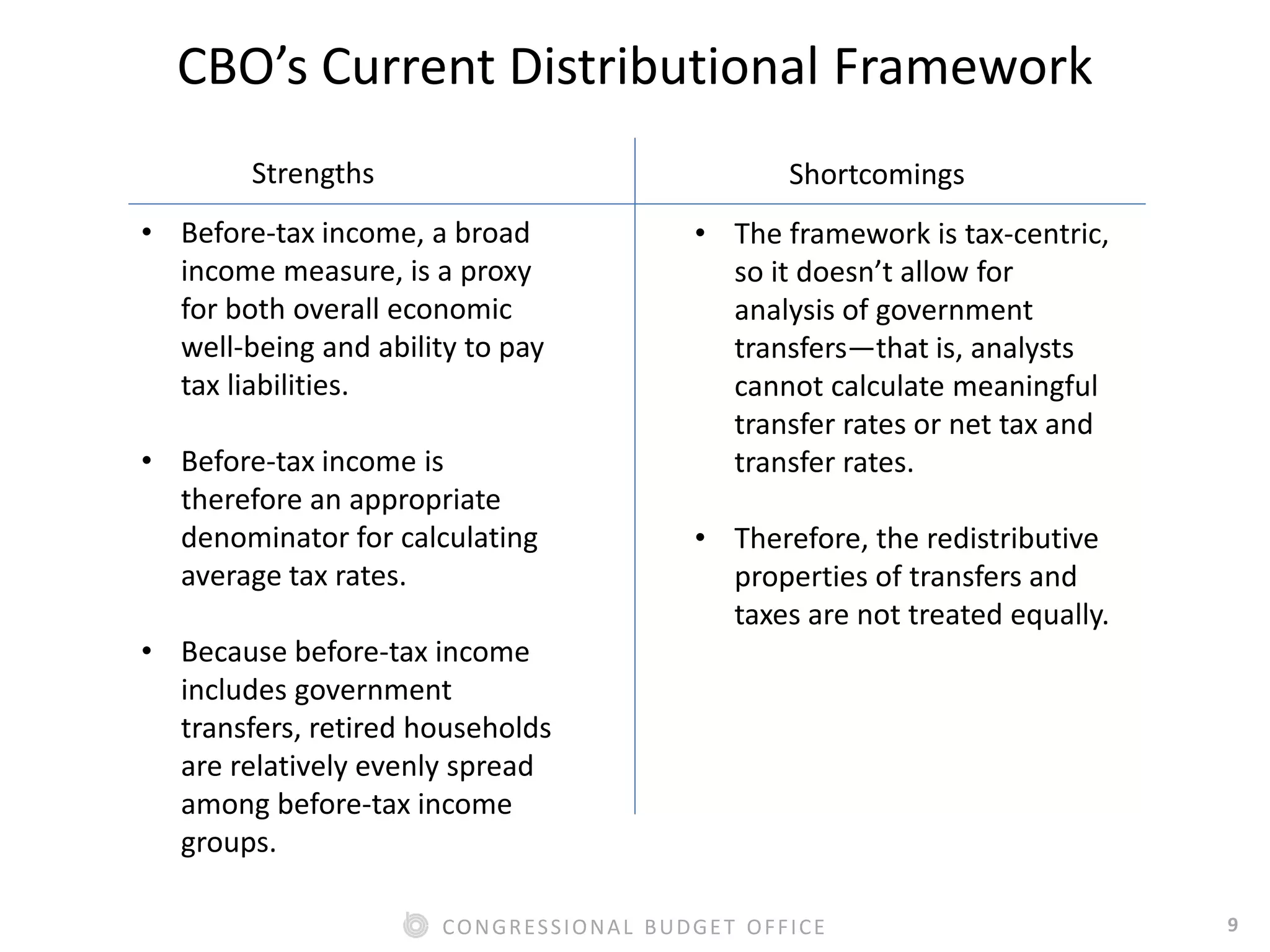

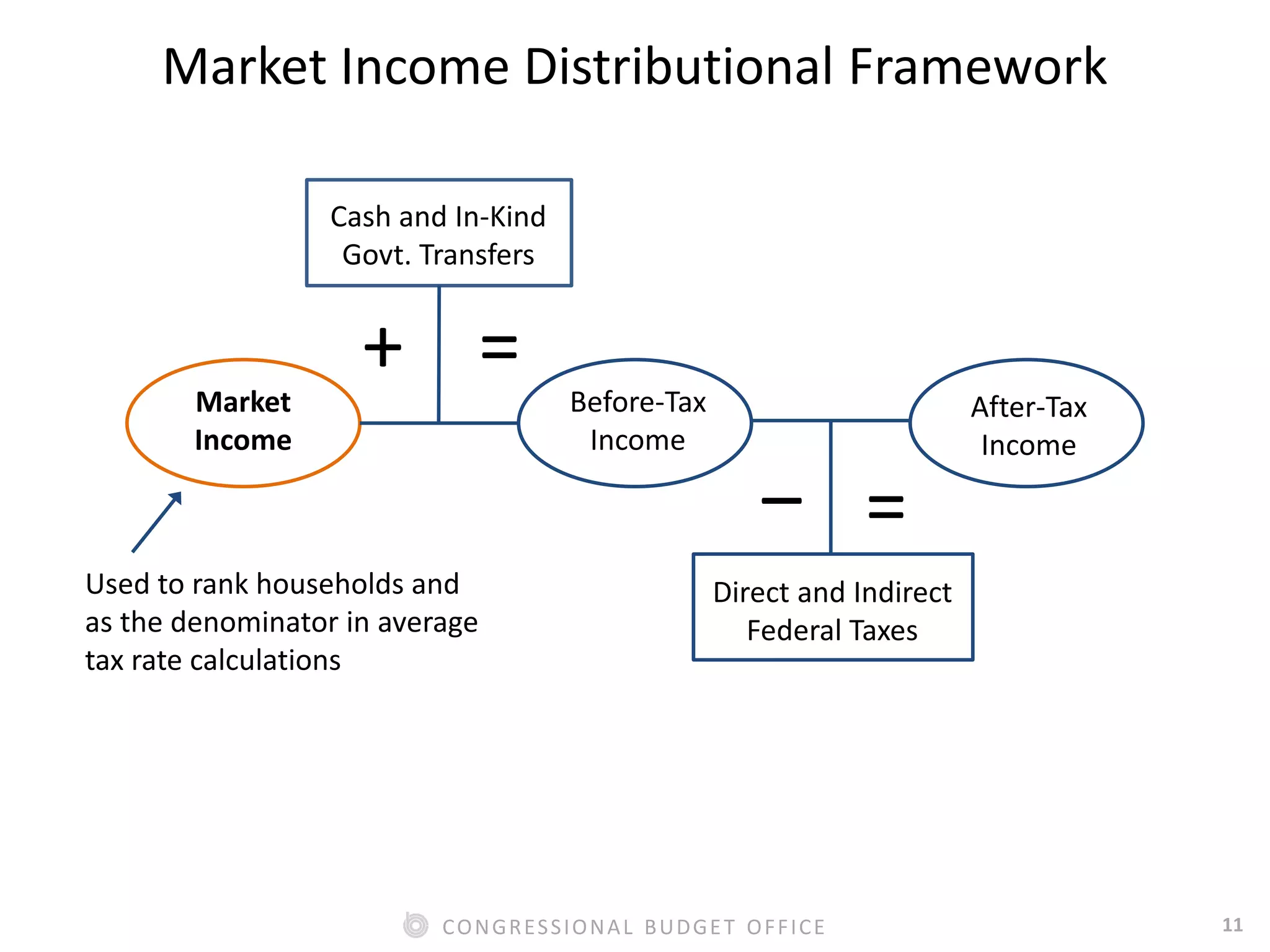

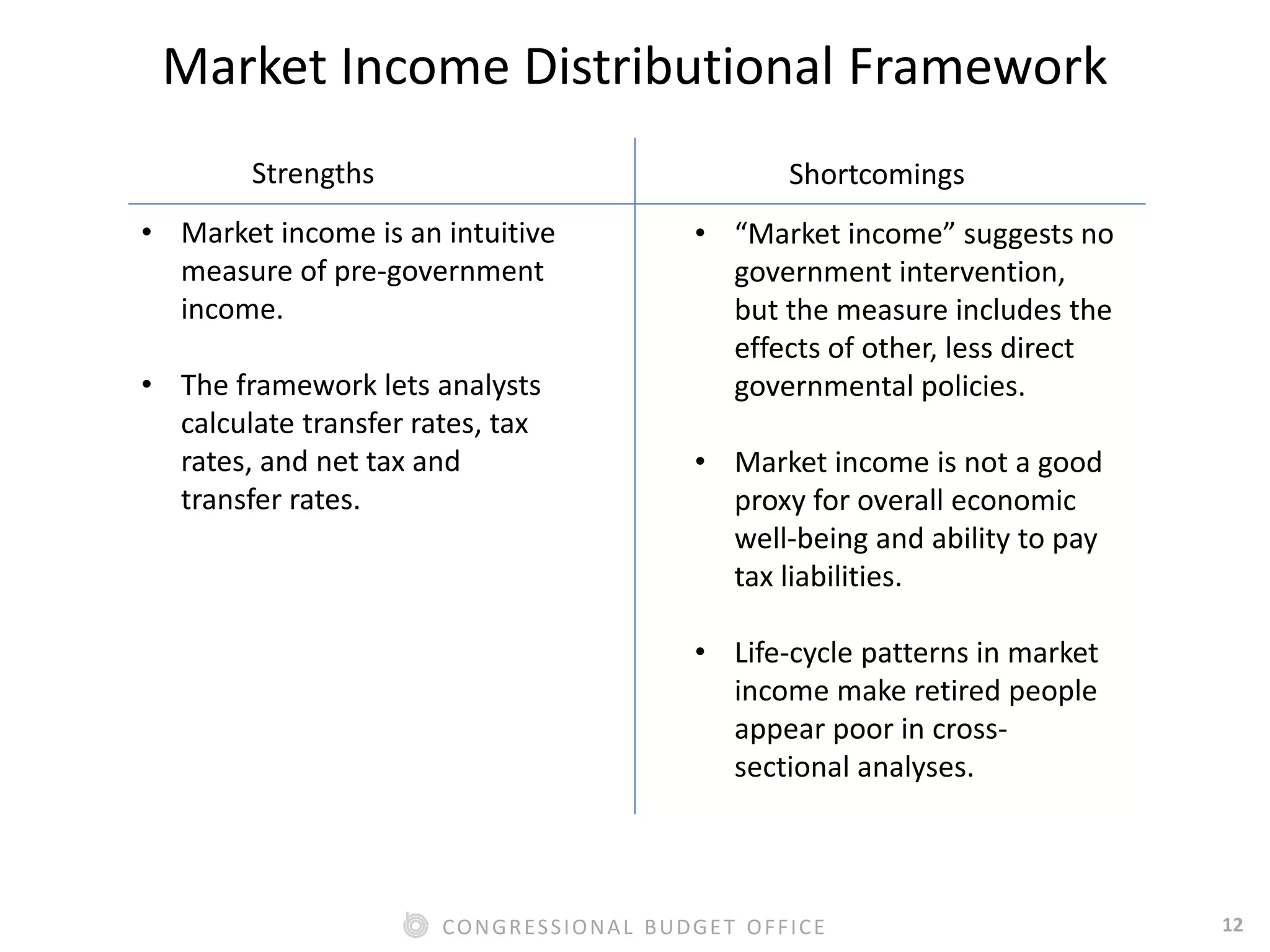

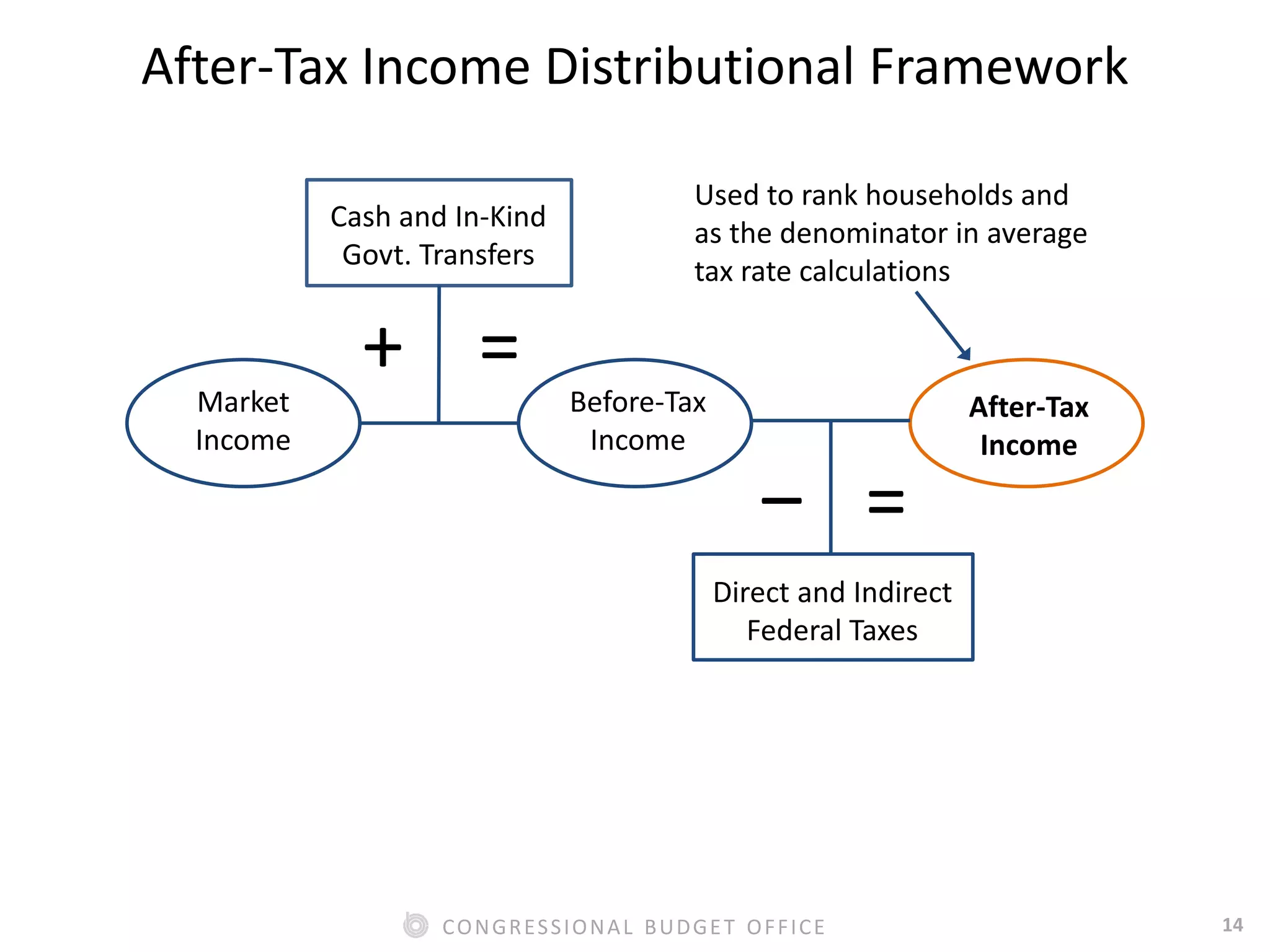

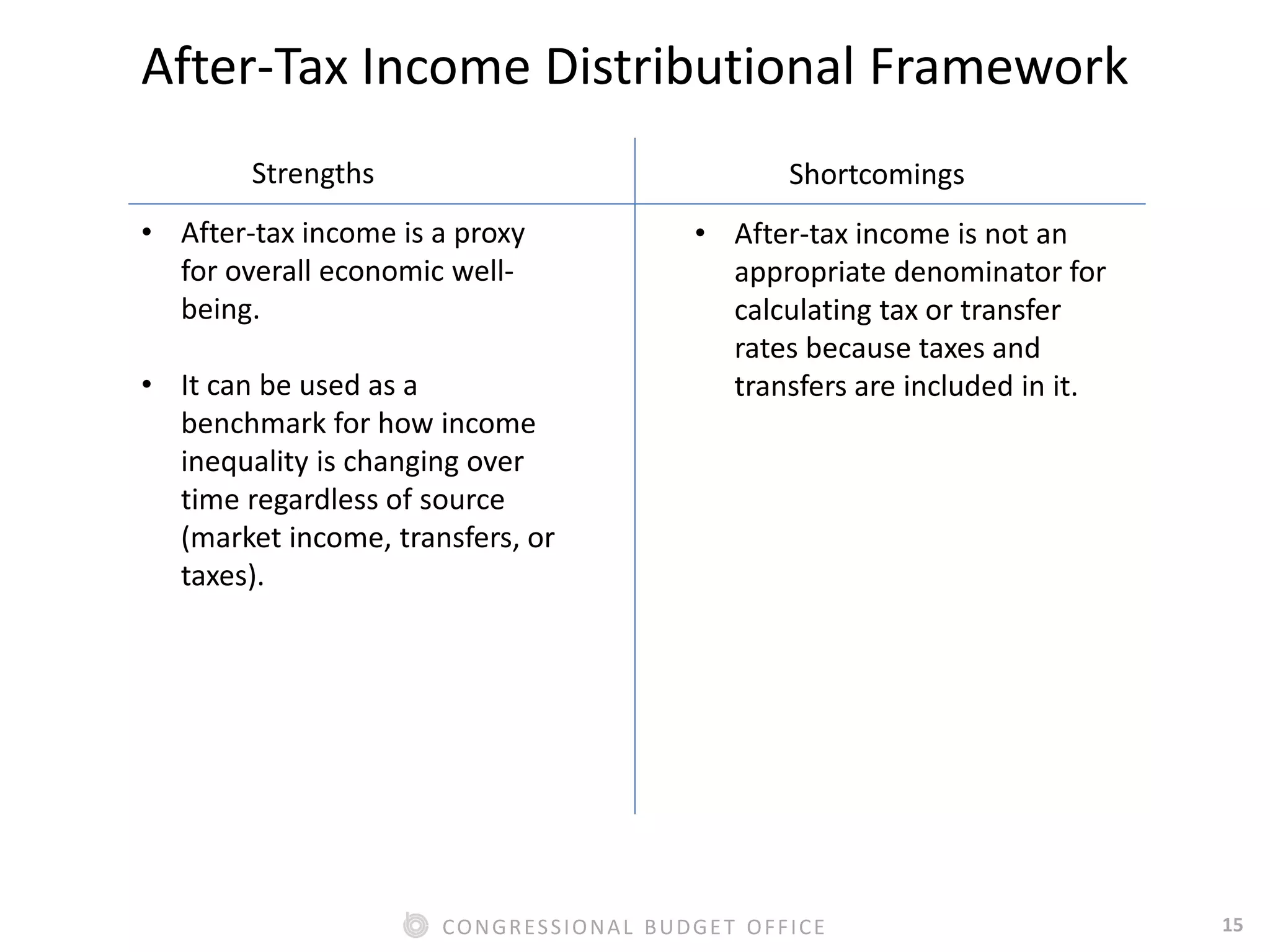

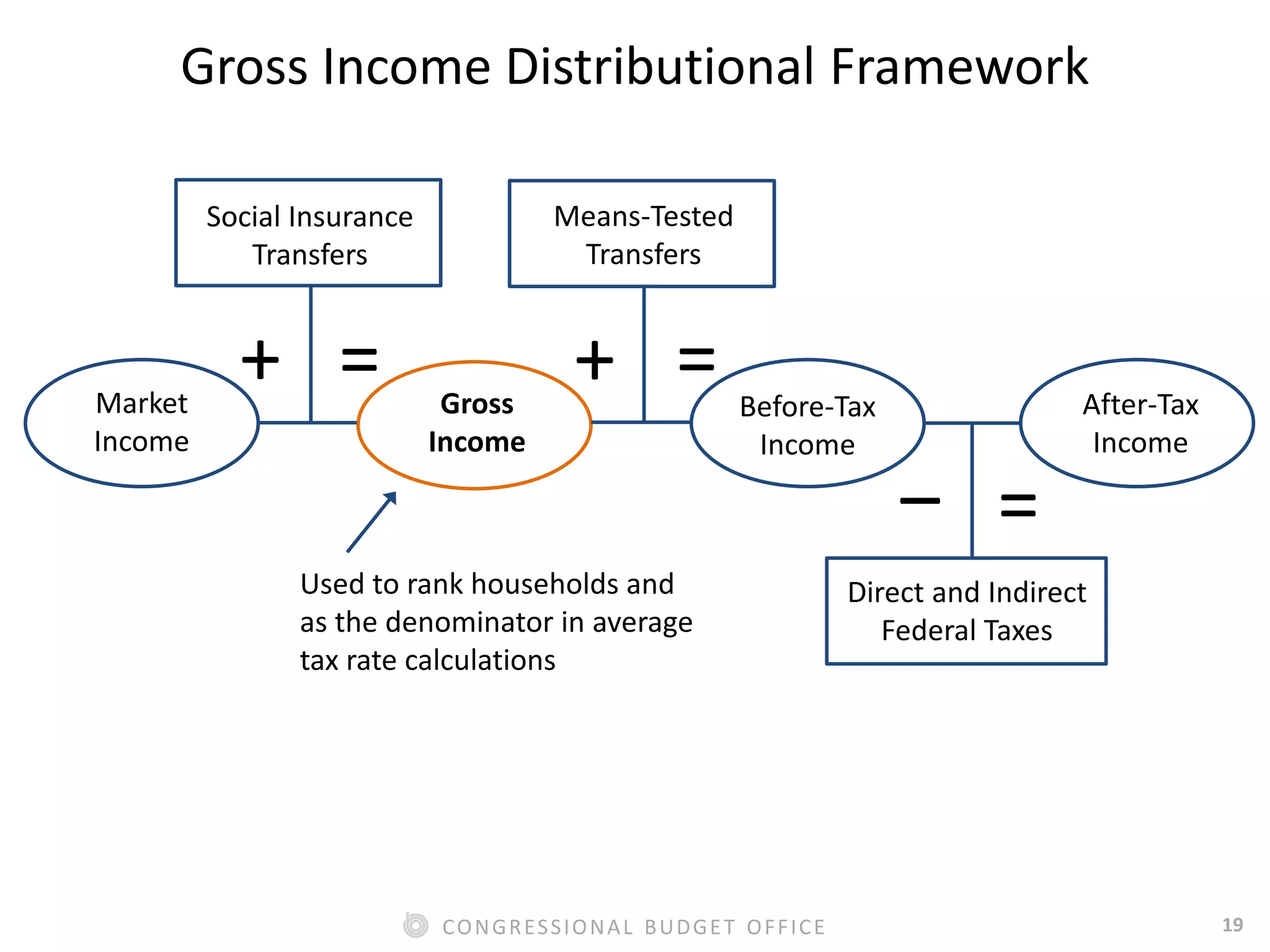

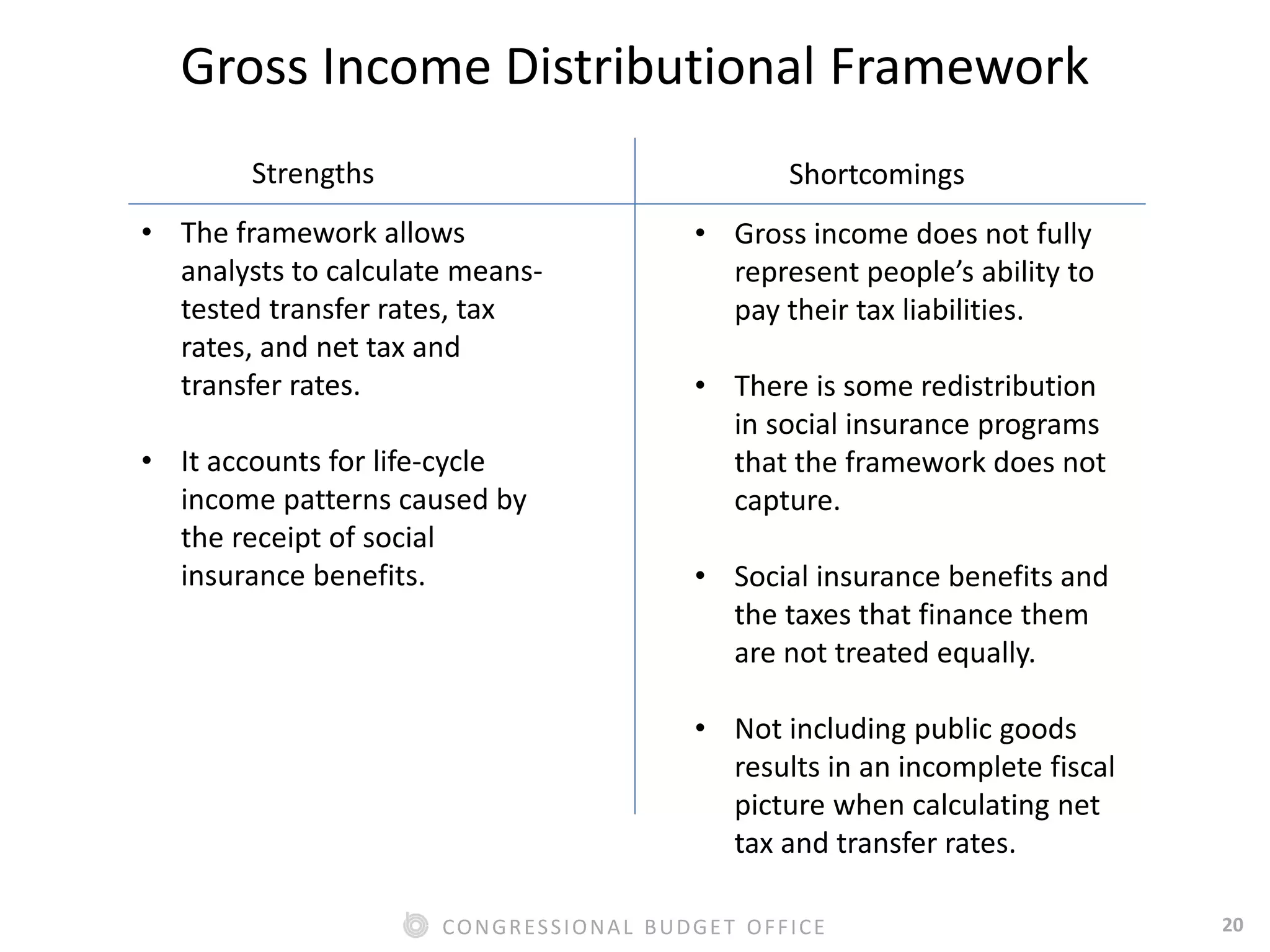

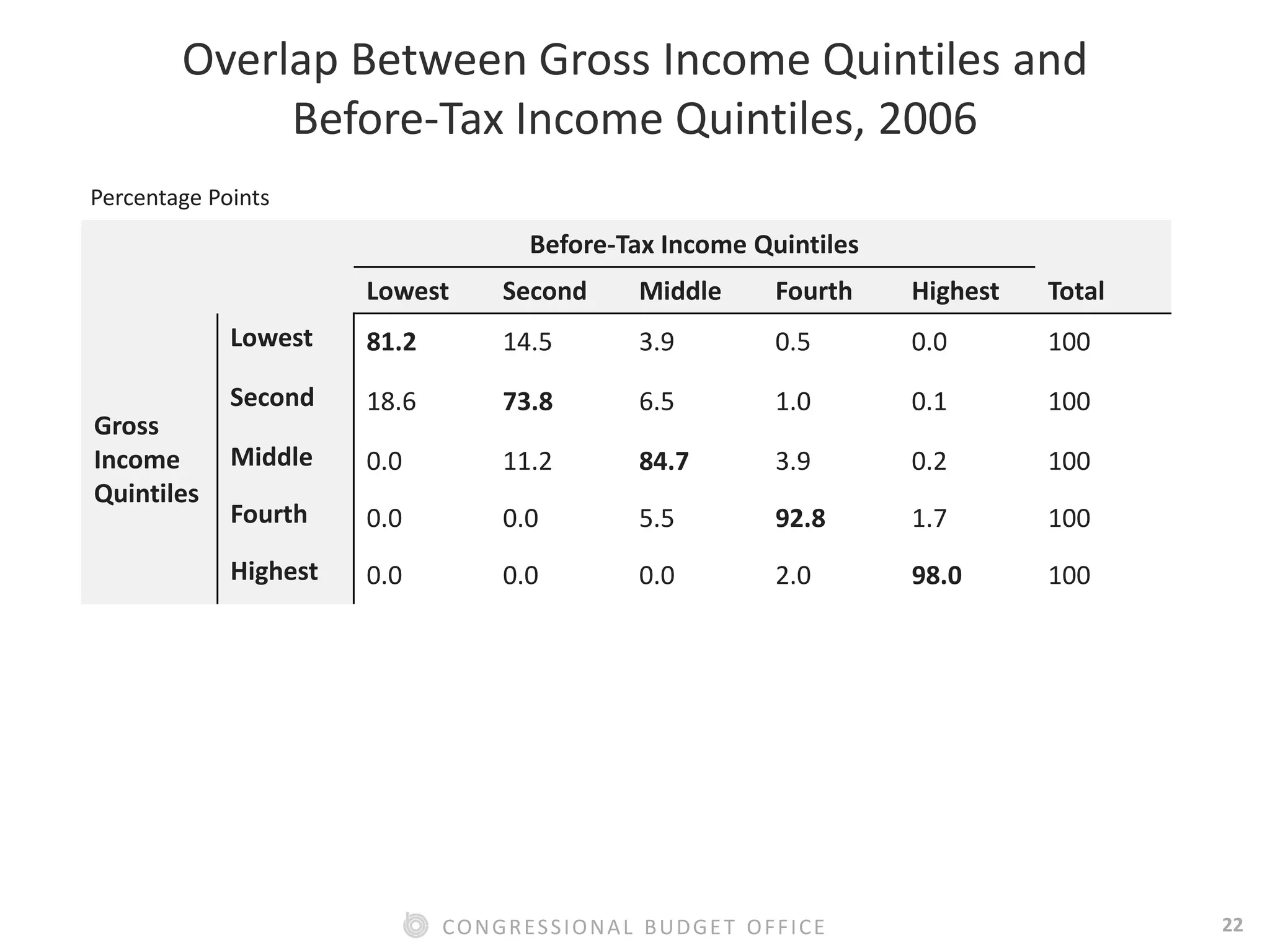

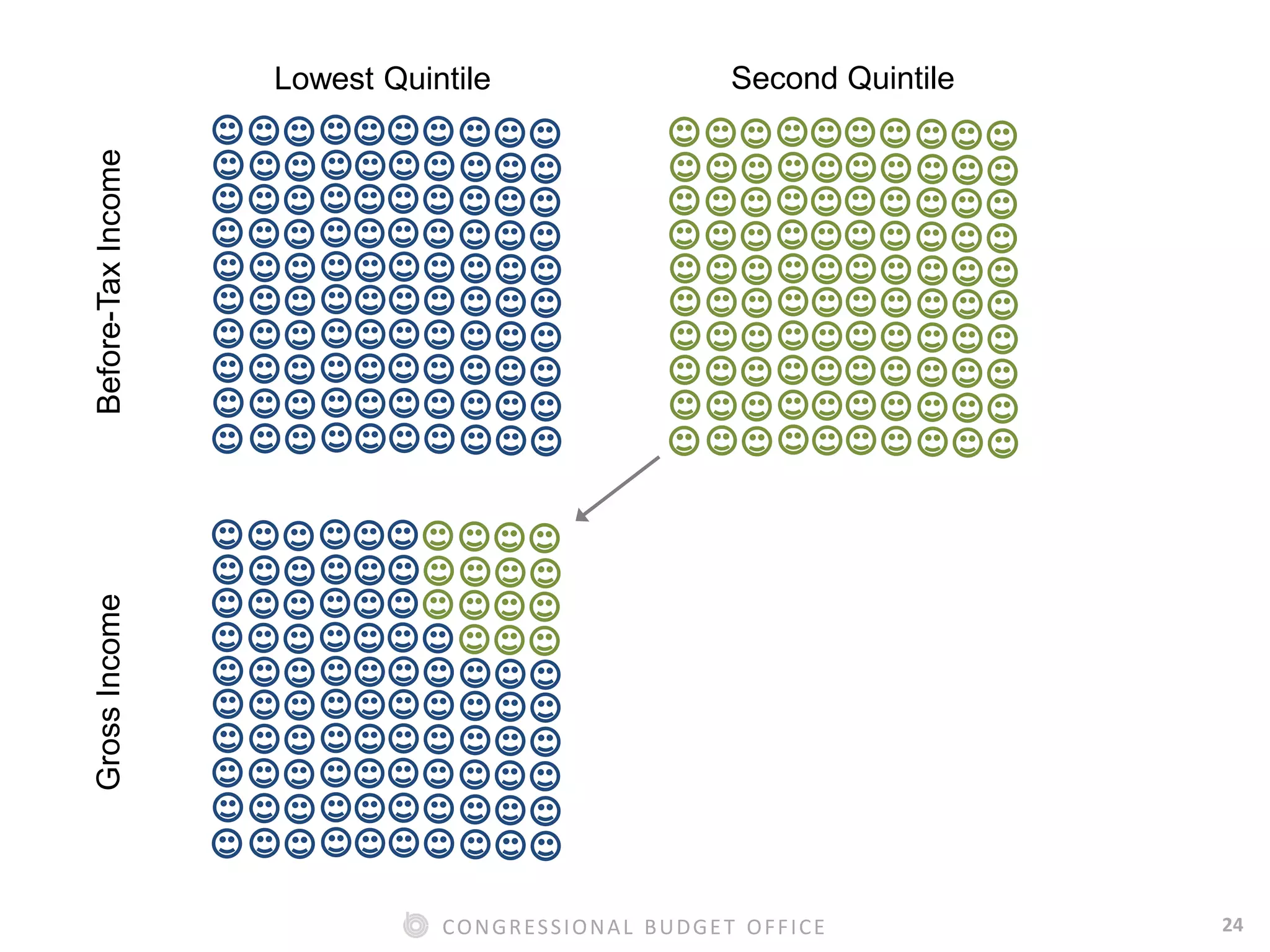

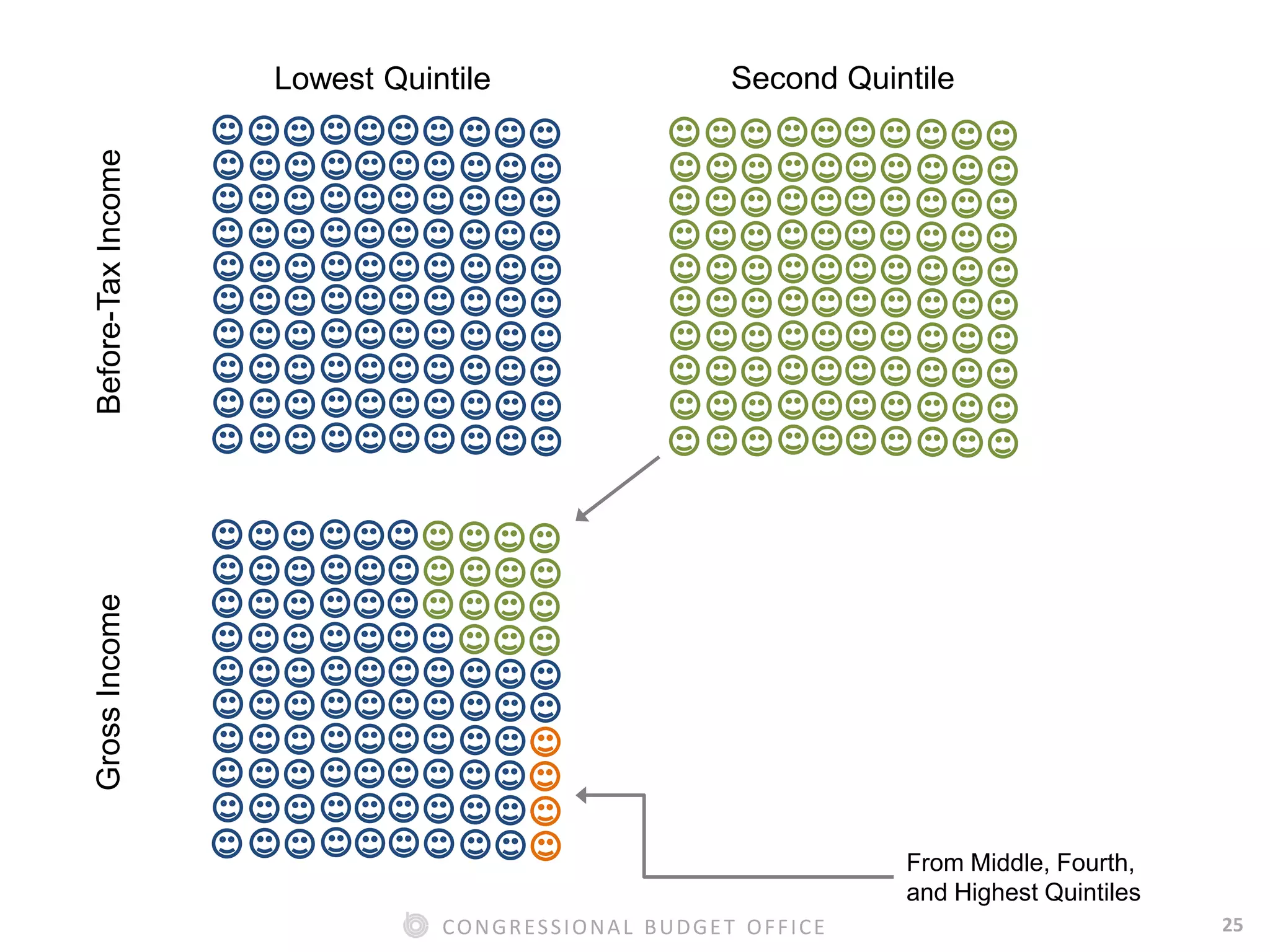

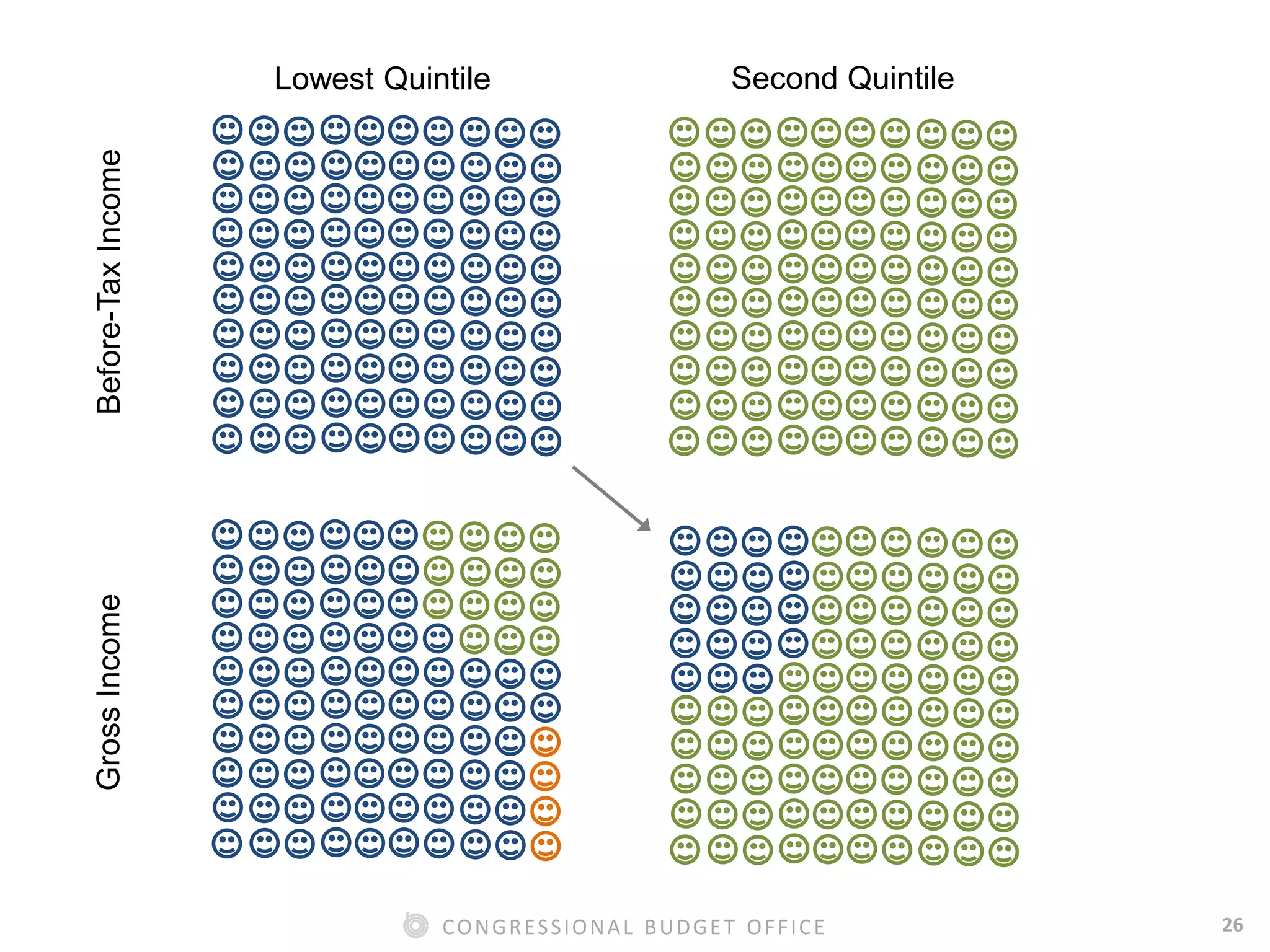

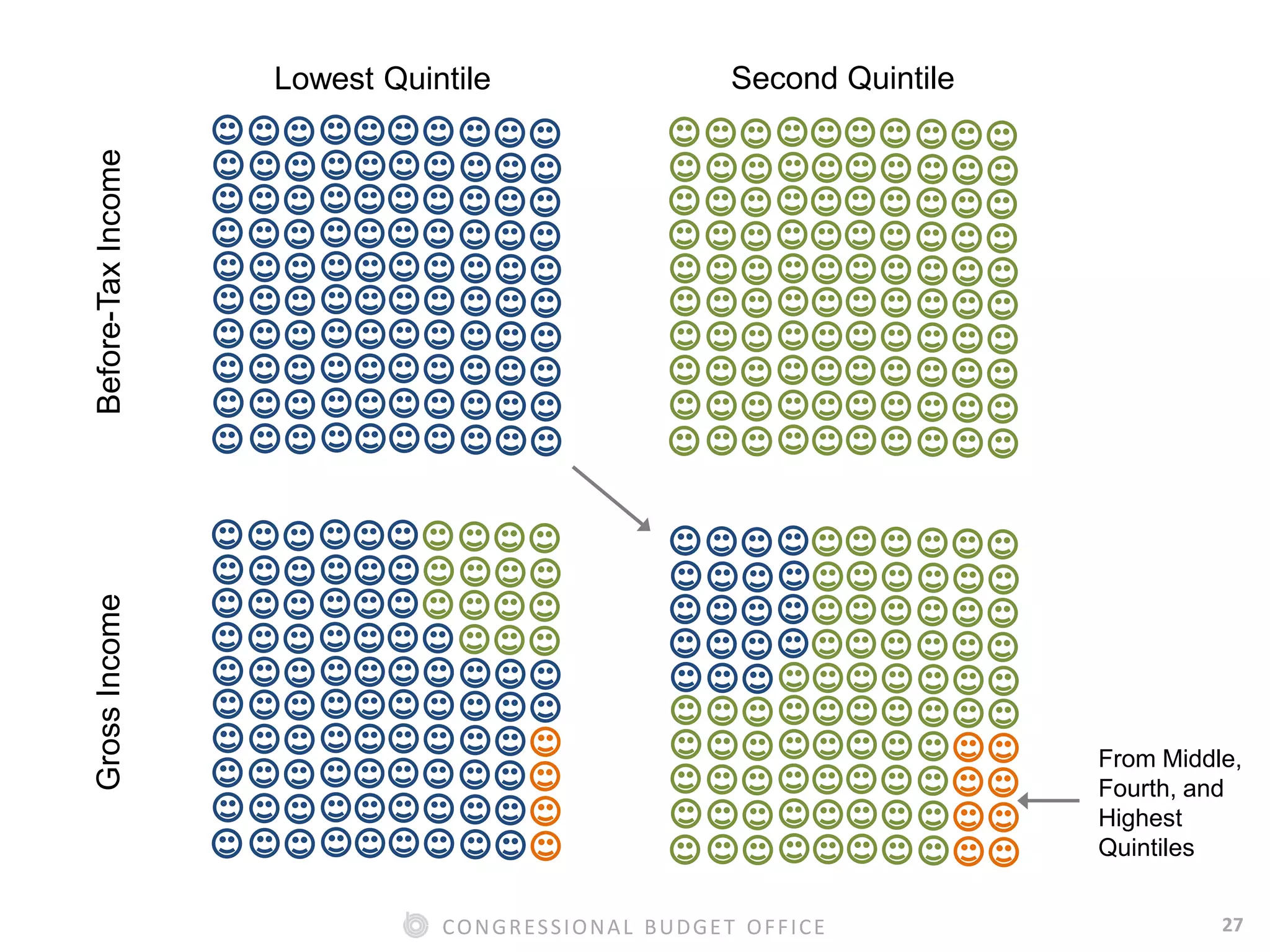

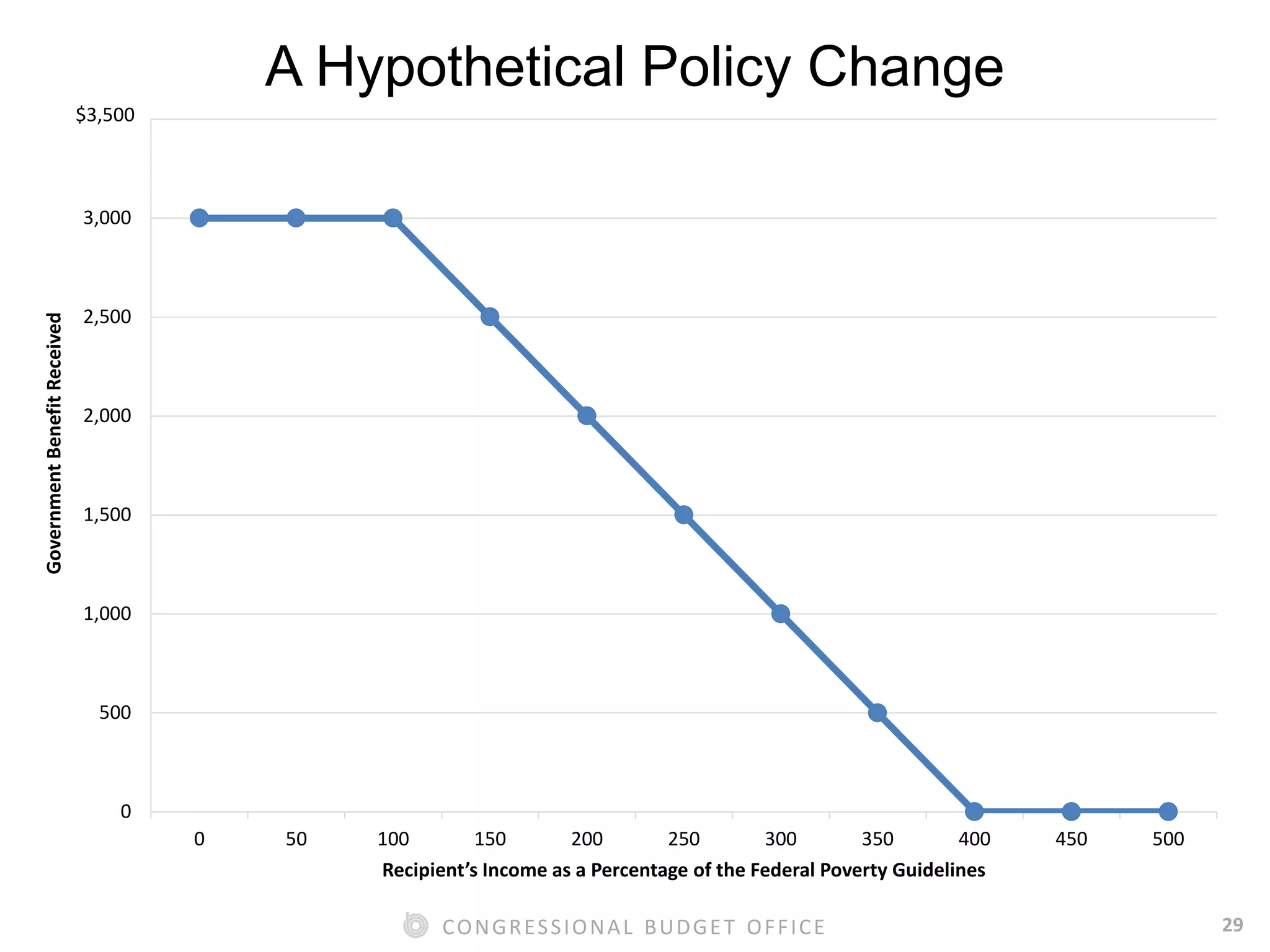

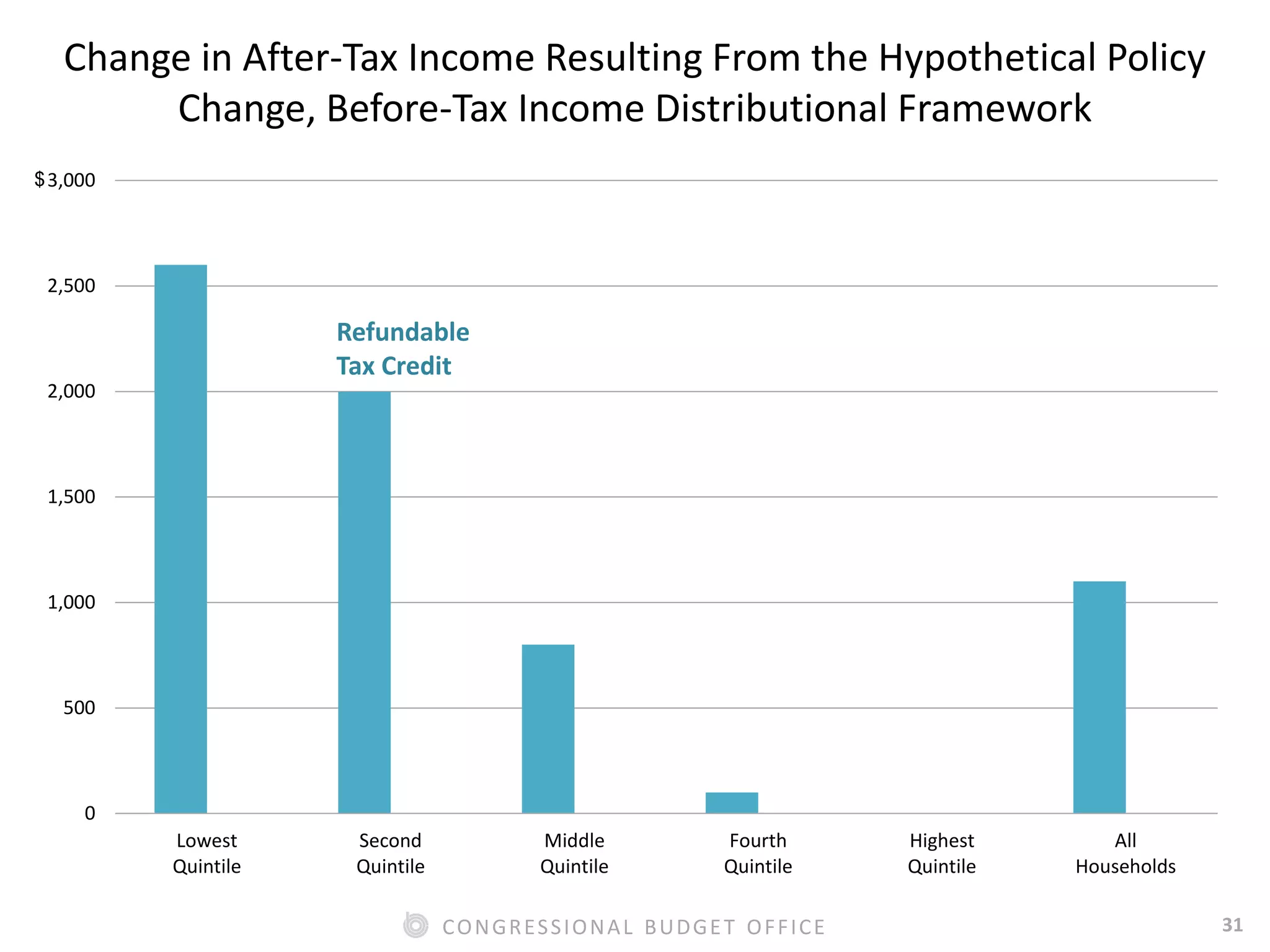

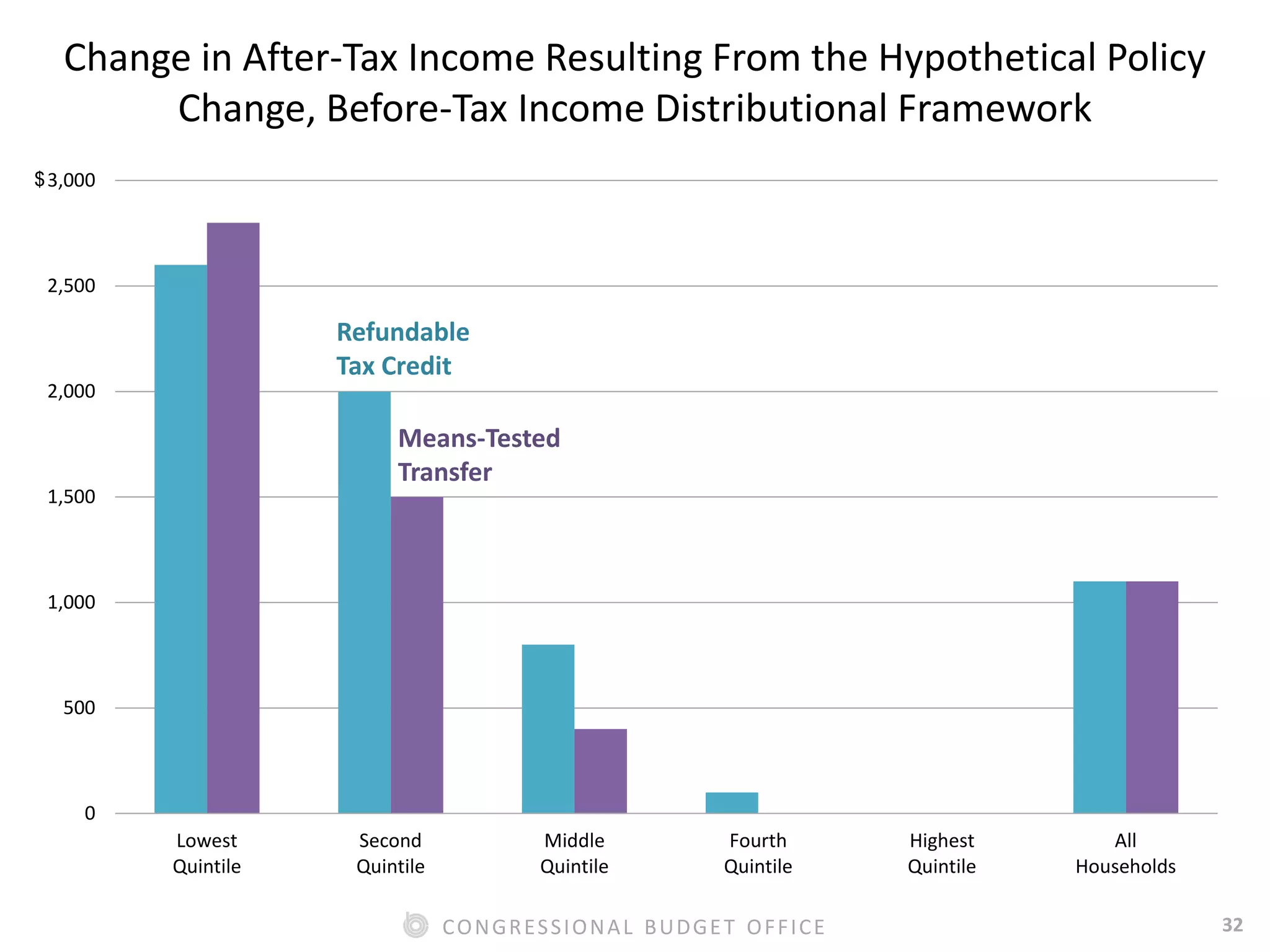

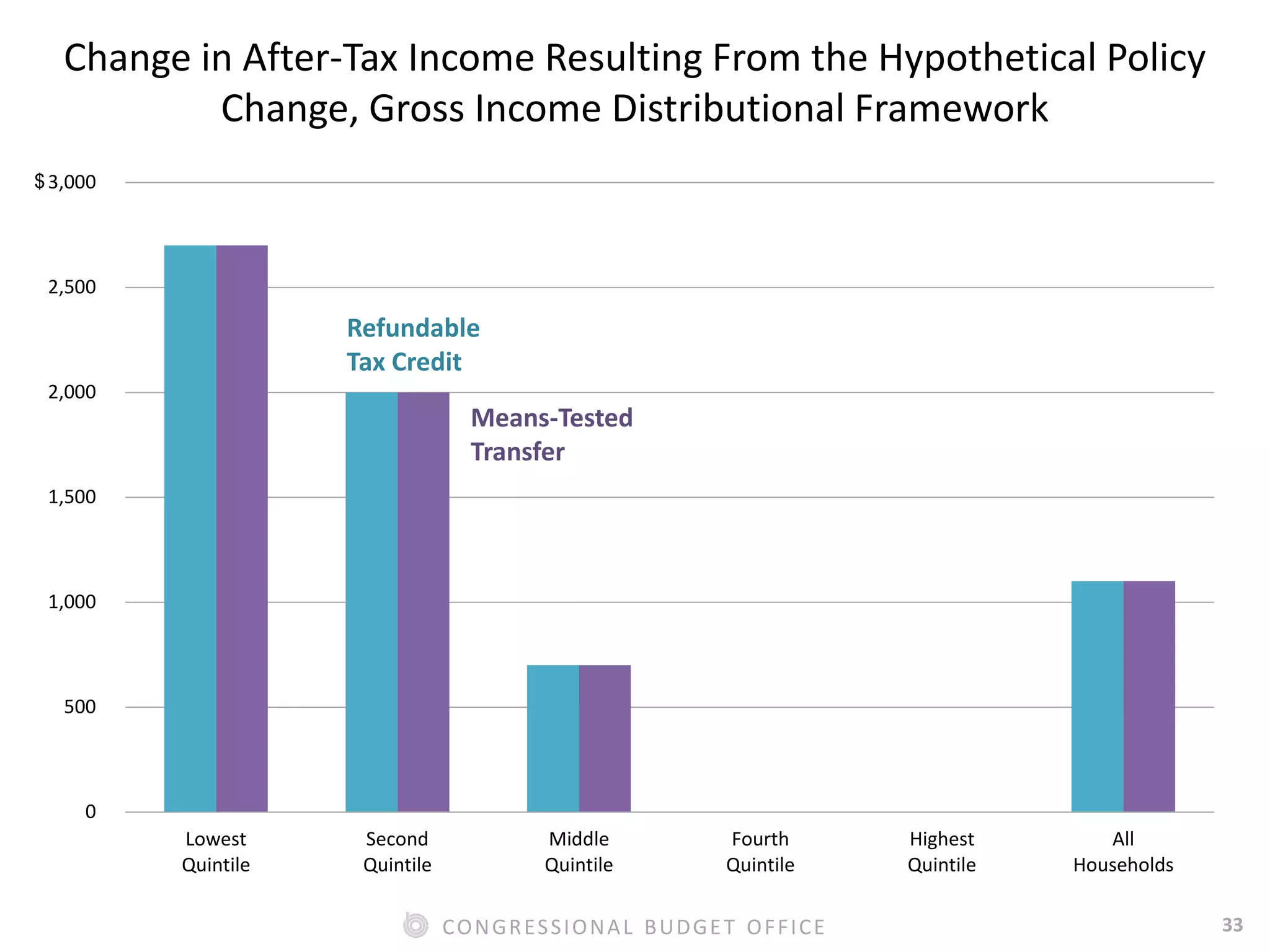

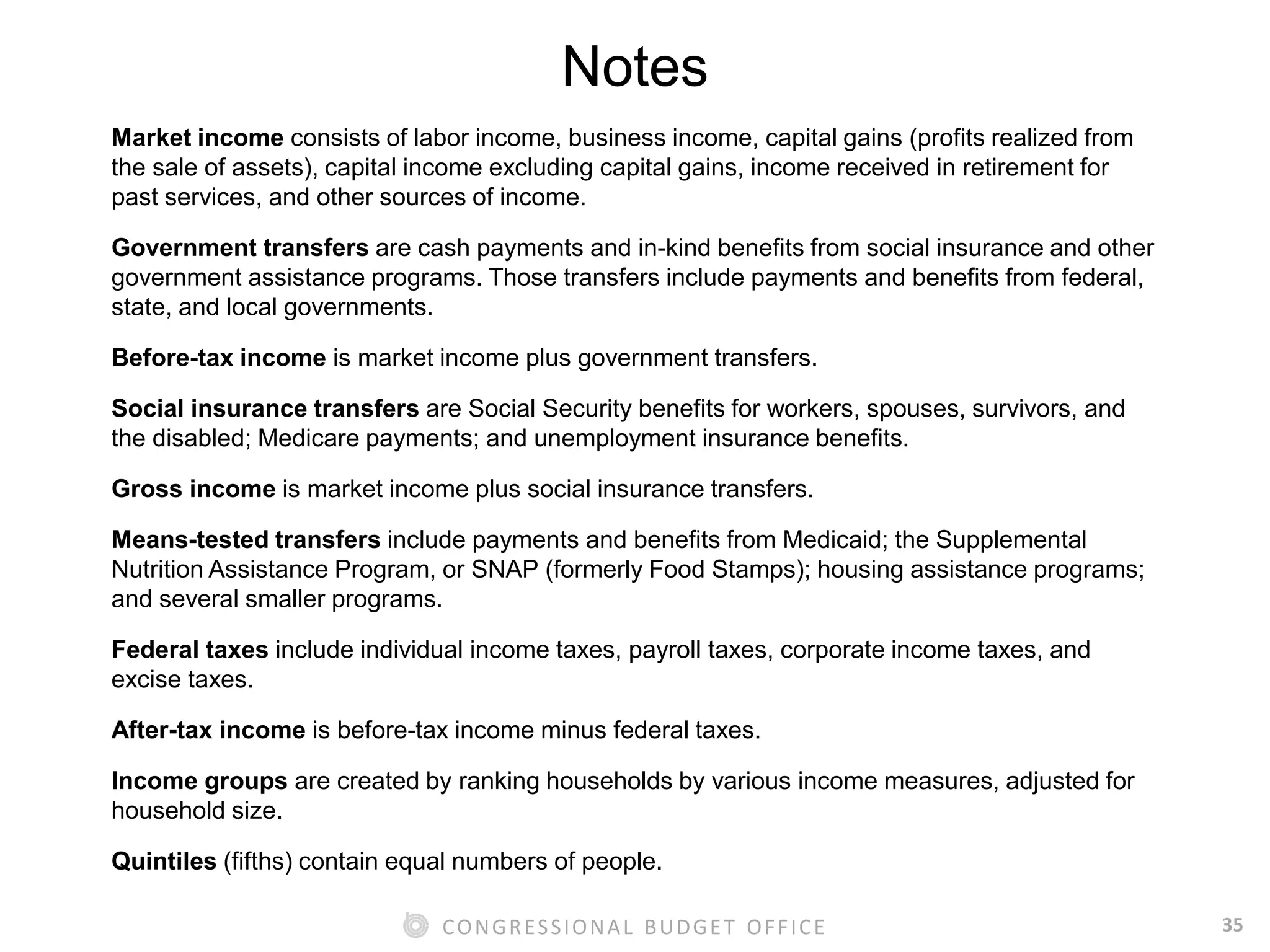

The document discusses frameworks for distributional analyses used by the Congressional Budget Office (CBO) in assessing the impact of taxes and government transfers on household income. It outlines different income measures, including market income, before-tax income, after-tax income, and gross income, highlighting their respective strengths and shortcomings. The document also emphasizes the importance of analyzing the distributional effects of policies, as results can vary significantly depending on the framework used.