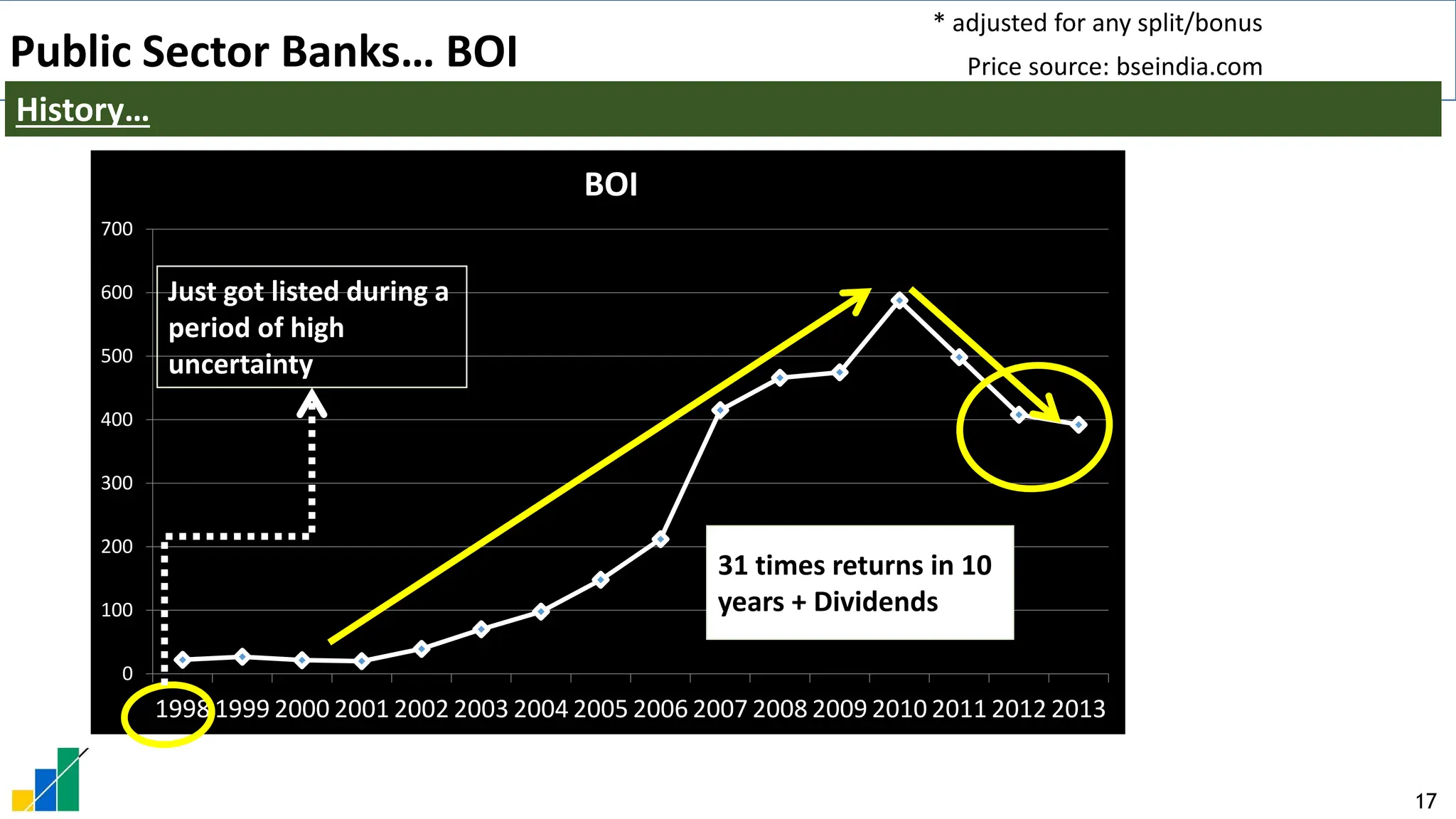

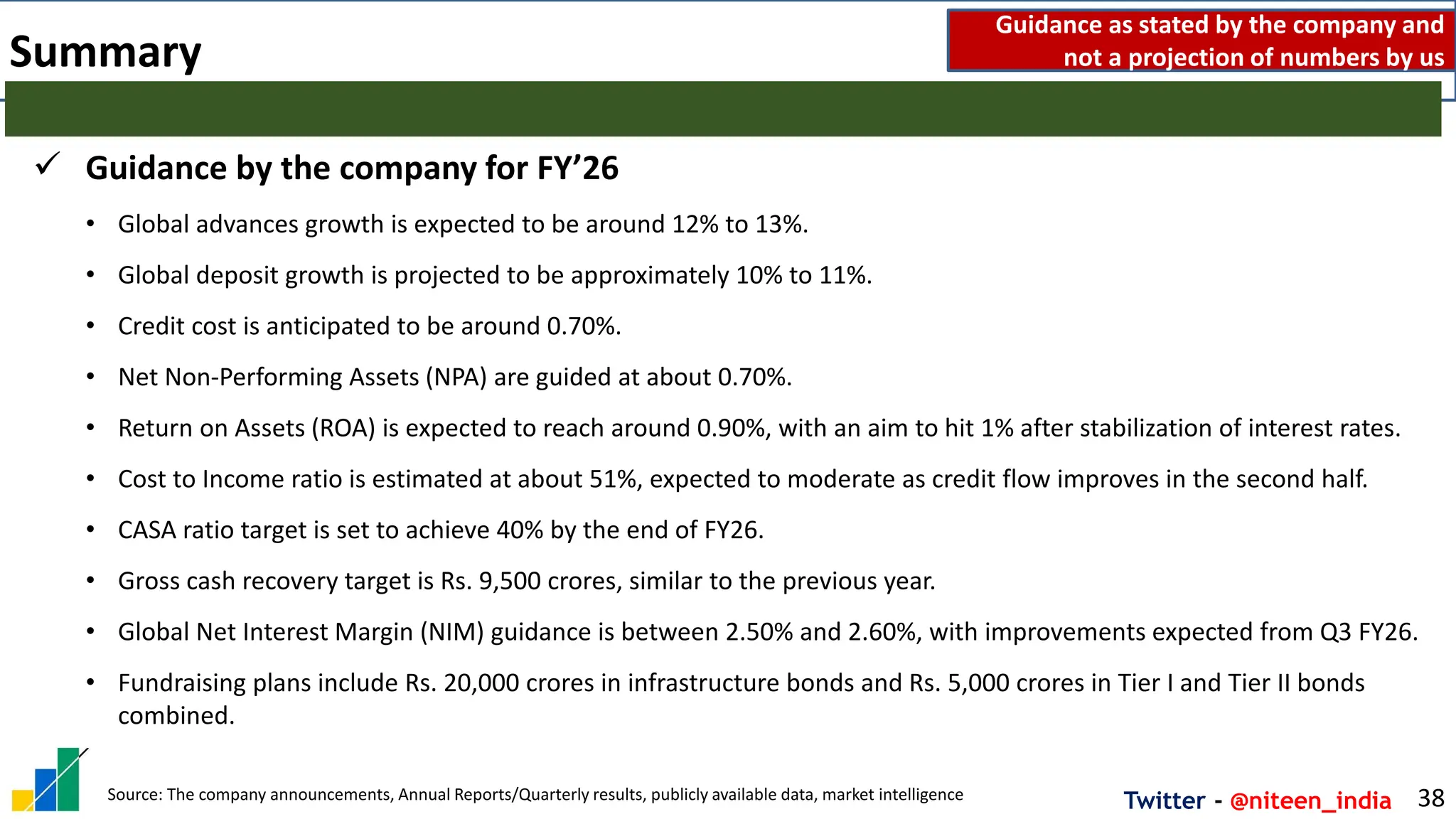

Niteen S Dharmawat, Co Founder, Aurum Capital, presented the business analysis of Bank of India Ltd in the Investing Accelerator Summit in Goa on 30 Aug 2025.

Please go through the Disclosure. This is not a buy/sell/hold recommendation. It is the business analysis of the company.