More Related Content

PDF

Keppel Ltd. 2H24 and FY24 Presentation Slides.pdf PDF

Keppel Ltd. 1Q 2024 Business Update Presentation Slides PDF

Keppel Ltd. 3Q 2024 Business Update Presentation Slides PDF

Keppel Investor Day 2024 Presentation Slides PDF

ZARIBEE Culture Deck(20240920) for candidates PDF

Onboarding LX Practice Essentials Powerpoiny.pdf PDF

RICHIND PLAN PRESENTATION ( use ).pdf.pdf PPTX

++(full video,,!!)* Sophie Rain Spiderman Video Clip Sophie Rain Original Video What's hot

PDF

Tech Adoption and Strategy for Innovation & Growth PDF

Right Cloud Mindset: Survey Results Hospitality | Accenture PDF

The Decade to Deliver: A Call to Business Action PDF

Federal Technology Vision 2021: Full U.S. Federal Survey Findings | Accenture PPTX

Unleashing Competitiveness on the Cloud Continuum | Accenture PDF

The Bionic Future - Future Work Summit PDF

#BainWebinar Next Generation Industrial Performance Post COVID-19 PDF

Fueling the Energy Future PDF

Shaping the Sustainable Organization | Accenture PDF

When, Where & How AI Will Boost Federal Workforce Productivity PDF

Pathways to Profitability for the Communications Industry PDF

Transforming the Industry That Transformed the World PDF

2020 Women in the Workplace Participant Briefing PDF

The Rise of Forerunners | Accenture PDF

Strategy Study 2014 | A.T. Kearney PDF

PwC's Global Technology IPO Review -- Q1 2015 PDF

Maximizing AI Investments | Accenture PPTX

Joining Forces: Interagency Collaboration and "Smart Power" PDF

PwC Trends in the workforce PDF

Lifting the Barriers to Retail Innovation in ASEAN | A.T. Kearney Similar to Keppel Ltd. 1Q 2025 Business Update Presentation Slides

PDF

Keppel Ltd. 1H 2025 Results Presentation Slides PDF

Keppel Corporation 1Q23 Business Update PDF

Keppel 3Q & 9M 2023 Business Update Presentation Slides PDF

Keppel Corporation - Annual General Meeting CEO's Presentation Slides PDF

Keppel Ltd. 9M 2025 Business Update Presentation Slides PDF

Keppel Investor Day 2025 Presentation Slides GCAT.pdf PDF

Keppel Ltd. AGM 2025 CEO Presentation Slides PDF

Keppel Corporation's 1H22 Financial Results PDF

Keppel Corporation 2H & FY2022 Results Presentation Slides PDF

Keppel Corporation's 2H & FY 2021 Financial Results Presentation Slides PDF

Keppel Corporation 1H 2023 Financial Results Presentation PDF

Keppel Corporation's 1Q 2022 Business Update Slides PDF

Keppel Corporation US NDR Presentation Slides - May 2019 PDF

Presentation Slides for HSBC Global Investment Summit PDF

Keppel Corporation UK Non-deal Roadshow 2019 PDF

keppel-ltd-3q-2024-business-update-presentation-slides.pdf PDF

Keppel Corporation's Vision 2030 Briefing to Analysts PDF

Keppel's Presentation Slides to Investors PDF

Keppel Corporation non-deal roadshow slides PDF

Keppel Corporation Presentation to Investors in Bangkok- September 2019 More from KeppelCorporation

PDF

Keppel Corporation AGM 2023 Presentation Slides PDF

Annual General Meeting Presentation Slides PDF

Keppel-Ltd-2h23-fy23-presentation-slides PDF

Keppel Corporation's Presentation Slides for US Non-Deal Roadshow PDF

Keppel Corporation 3Q & 9M 2022 Business Update Presentation Slides PDF

2 keppel ltd 1h24 presentation slides.pdf PDF

Keppel Corporation - Briefing to media and analysts on accelerating transform... PDF

Presentation on proposed acquisition of leading European asset manager Aermon... PDF

SIAS-Keppel Briefing to Retail Shareholders 2023.pdf PDF

Keppel_Proposed Divestment of M1 Limited PDF

Presentation at Citi-SGX-REITAS REITs Sponsors Forum PDF

Keppel Capital's Presentation Slides for REITs Symposium in Singapore PDF

Keppel Corporation signs definitive agreements in connection with proposed co... Recently uploaded

PDF

Lion One Corporate Presentation November 2025 Revised PPTX

The Code On Social Security and their application PDF

How to Buy Verified RedotPay Account.pdf DOCX

How to Buy TikTok Seller Account 9.99.docx PDF

Humans cannot be transformed but we can help them - PLM Roadmap PDT Europe 20... PDF

How can I buy a verified Binance account_.pdf PDF

Top 5 Places to Buy Aged LinkedIn Accounts and Should ....pdf PDF

Strategic Thinking in Action: A conversation with Steven Haines PDF

CHAPTER 2 POSITIONING AND BRANDING of company PDF

Poultry Farm Investment Proposal in Minjar Woreda, Southern Shewa Zone, Amhar... PDF

RBI_ARC_Master_Directions_2025_Strategic_Guide.pdf PDF

by Best Platforms to Buy Twitter Accounts in 2025.pdf PPTX

Shark Tank Project Presentation Sample 1.pptx PDF

HOW To Buy Snapchat Accounts in first 2026-27.us uk.pdf PPTX

Identity Theft Prevention, all you need to know PDF

Where to Buy LinkedIn Accounts_ [12 Best Sites] (2).pdf PPTX

How Does a Security Guards Company in Los Angeles County Screen Its Security ... DOCX

Trusted Top Site to Buy Verified PayPal Account Online Finance.docx PDF

HIROSHI BRYAN VO - A Bilingual Voice Actor PDF

Joseph Heiman New Jersey - Passionate About Finance Keppel Ltd. 1Q 2025 Business Update Presentation Slides

- 1.

- 2.

© Keppel 2

Globalasset manager & operator

• Net profit improved strongly yoy

• Steady progress in asset monetisation, despite challenging

environment

• Stronger recurring income

• Asset management earnings and fees continued to expand

• Encouraging fund raising momentum for data centre

and real estate flagship funds

• FUM has grown, closer to targets of $100b by end-2026

and $200b by end-2030

• New Keppel well placed to navigate the volatility ahead

- 3.

3

© Keppel

• Netprofit was >25% higher yoy, excluding legacy O&M assetsi

• Steady infrastructure earnings coupled with improved performance in real estate

• Stronger asset management performance, includes a full quarter of contributions from Aermont Capital

• Net profit including legacy O&M assets more than doubled yoy with lower losses from the legacy assets

i Legacy offshore and marine (O&M) assets comprise Seatrium shares, the legacy rigs, Floatel, KrisEnergy and Dyna-Mac (which was divested in 2024).

>80% of net profit, excluding legacy O&M assets, was recurring

Higher net profit

Stronger recurring income

Robust performance in 1Q 2025

- 4.

© Keppel 4

$347m

Announcedin YTD 2025,

mainly from China & Vietnam

real estate projects

about $550m

Potential real estate monetisations

expected to be finalised in next few months

Good progress in asset monetisation programme:

Termination of segregated account:

i Figures were as at 31 Mar 2025.

Unlocking value with an asset-light strategy

Keppel is in a strong position, with the financial flexibility to fund growth, reduce debt and

reward shareholders.

Released $291m in cash and 63.36 million Seatrium shares for deploymenti

Deals in advanced stages of negotiations

- 5.

Asset management feesi

©Keppel 5

i Includes 100% fees from subsidiary managers, joint ventures and associated entities, annualised fees for platform/asset acquired during the year, as well as share of fees based on shareholding stake in

associate with which Keppel has strategic alliance. Also includes asset management, transaction and advisory fees on sponsor stakes and co-investments.

ii Excludes Aermont.

iii Includes another $400m raised for Keppel Data Centre Fund III in late 2024.

Note: Gross asset value of investments and uninvested capital commitments on a leveraged basis is used to project fully-invested Funds under Management (FUM).

$1.6b in YTD 2025

3.5x higher, compared to $436m in the same period last year

Equity raisedii

37

18

40

66

11

12

1Q24 1Q25

Infrastructure Real Estate Connectivity

$96m

$88m +9%

$2.7b in YTD 2025

Acquisitions & divestmentsii

2.5x higher, compared to $1.1b in the same period last year

Robust momentum in asset management

Secured $2.0biii total capital commitments

for new private funds with $4.9b FUM:

• Substantial capital commitment for SUR strategy

• First closings for Education Asset Fund II and

Data Centre Fund III

- 6.

© Keppel 6

KeppelSakra Cogen Plant: achieved commissioning

readiness, on track to commence commercial

operations in 1H 2026

Keppel South Central: construction completed, and

major financial institution secured as first anchor tenant

Subsea Cable Systems: Bifrost’s cable laying

operations was 92% completed as at end-Mar 2025,

on track to be ready for service in 2H 2025

Strong progress across operating divisions

Infrastructure

Keppel’s position as a connectivity ecosystem

partner boosted by private fund and listed trust’s joint

investment in leading subsea cable solutions provider,

Global Marine Group

Keppel Merlimau Cogen Plant: 39% stake seeded to

Keppel Core Infrastructure Fund

Decarbonisation & Sustainability Solutions: grew

long-term contract revenue by 31% yoy to $6.3b;

expected to contribute >$100m EBITDA p.a. from 2025

onwards

Real Estate

Connectivity

- 7.

© Keppel 7

Onthe recent US tariffs

• Limited direct impact from the US tariffs expected, as Keppel is not involved in the manufacturing or

export sectors

• Keppel provides many essential services, as seen during the COVID-19 pandemic, generate stable

recurring income

• Meeting demand for alternative real assets supported by macrotrends such as climate change,

energy transition, increasing digitalisation and the AI wave

• Nevertheless, a trade war would be highly detrimental to the international economy and business

environment

• Various possible indirect impacts on Keppel include rising supply chain costs, market confidence,

exchange rates, asset monetisation, etc.

• Highly volatile situation, which continues to evolve rapidly. We will continue to monitor the

developments closely

Whilst it is still too early to know the full impact on the global economy and business outlook,

the New Keppel is well placed to navigate the volatility ahead.

- 8.

© Keppel 8

Improvednet profit

Stronger recurring income

Steady progress in asset monetisation

Expanding asset management earnings and fees

• Flagship funds gaining momentum

• Advancing towards FUM targets

The New Keppel

We are meeting demand for alternative real assets

anchored to resilient macrotrends.

- 9.

- 10.

End-Mar 2024 End-Mar2025

$4.8b

$6.3b

10

Integrated Power Business Decarbonisation & Sustainability Solutions

Strong earnings growth

• $6.3b of long term contract revenue to be

delivered over 10-15 years, building up recurring

cashflows

• >$100m p.a. EBITDA expected to be

contributed from 2025 onwards

© Keppel

Resilient recurring earnings

• 66% of power capacityi contracted for

three years & above, with diversified

customer base

Projects

16%

9%

24%

25%

37% 48%

23%

18%

End-Mar 2024 End-Mar 2025

>10 years

3-10 years

1-3 years

<1 year

Infrastructure Division updates

i Based on Keppel’s existing generation capacity.

ii IWMF stands for integrated waste management facility.

• Keppel Sakra Cogen Plant achieved

commissioning readiness, on track

to commence commercial operations

in 1H 2026

• Hong Kong IWMFii and Tuas Nexus

IWMF were 91% and 69% completed

respectively as at end-Mar 2025

Japan Bank for

International Cooperation

• MOU to advance the energy transition

and promote sustainable

digitalisation in Asia

• Collaborating across areas such as

renewable energy, data centres and

subsea cables

+31%

- 11.

11

© Keppel

i Assetvalues as of end-Mar 2025.

ii ~40% of commercial GFA is under development.

Real Estate Division updates

Residential landbank Units %

Singapore 112 1%

China 15,001 45%

Vietnam 6,984 21%

Indonesia 7,067 21%

India 4,190 12%

TOTAL 33,354 100%

Commercial portfolioii GFA (sm) %

Singapore 87,510 5%

China 536,340 32%

Vietnam 401,210 25%

India 346,400 21%

Indonesia 153,800 9%

Other SEA countries 103,100 6%

South Korea 39,770 2%

TOTAL 1,668,130 100%

As of end-Mar 2025

Keppel South Central

• Completed construction

and welcomed leading

financial services group as

anchor tenant

• ~50% of office space and

retail units committed or in

active negotiation

Asset monetisation

• $3.9b of real estate assets

made up 54% of Keppel’s

$7.2b cumulative asset

monetisation as at YTD 2025

Sustainable urban renewal

• Implementing SUR solutions

across five projects with a

combined asset value of $1.7bi

Keppel South Central is a BCA

Green Mark Platinum Super

Low Energy certified building

- 12.

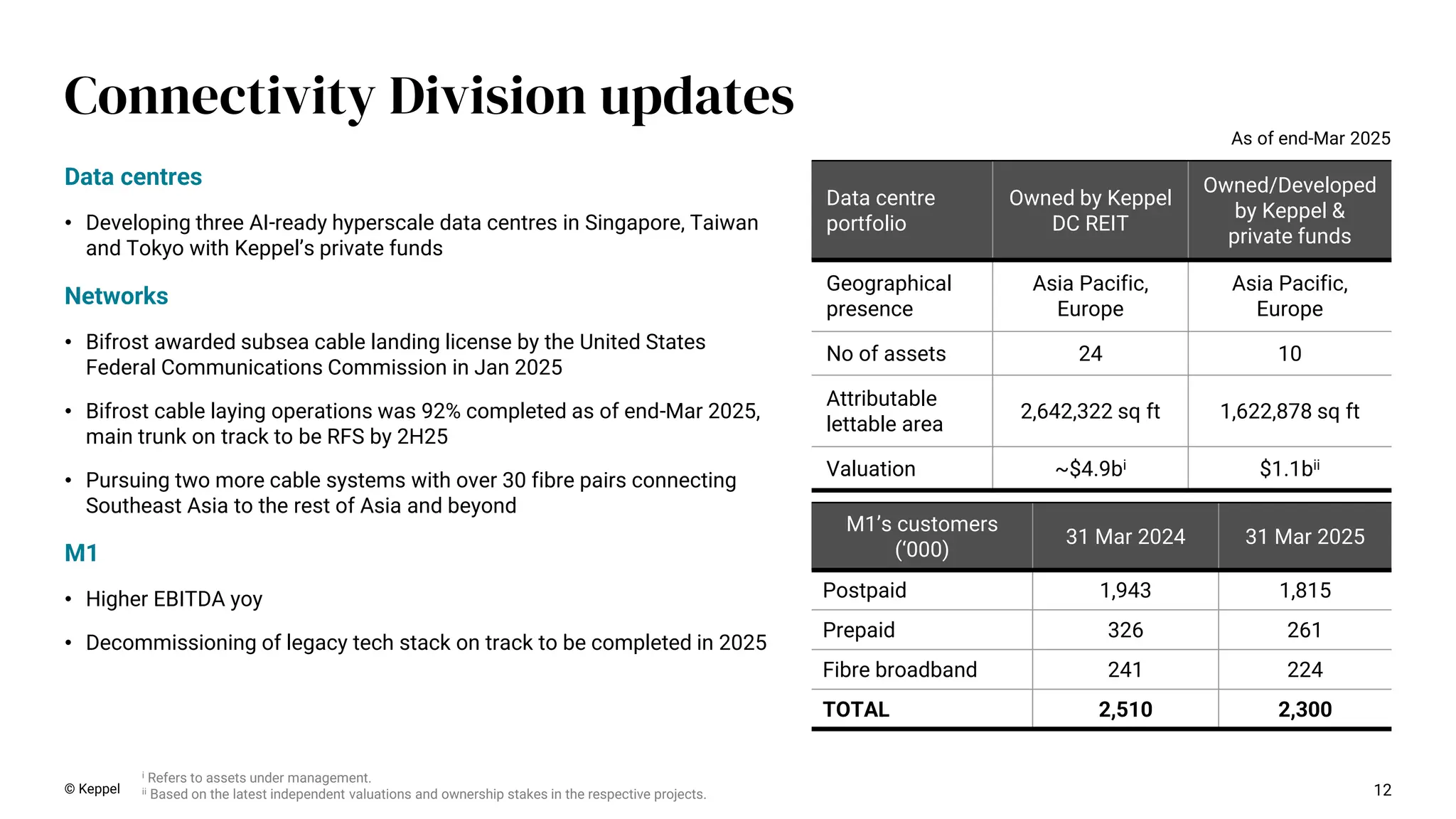

Data centre

portfolio

Owned byKeppel

DC REIT

Owned/Developed

by Keppel &

private funds

Geographical

presence

Asia Pacific,

Europe

Asia Pacific,

Europe

No of assets 24 10

Attributable

lettable area

2,642,322 sq ft 1,622,878 sq ft

Valuation ~$4.9bi $1.1bii

12

© Keppel

M1’s customers

(‘000)

31 Mar 2024 31 Mar 2025

Postpaid 1,943 1,815

Prepaid 326 261

Fibre broadband 241 224

TOTAL 2,510 2,300

i Refers to assets under management.

ii Based on the latest independent valuations and ownership stakes in the respective projects.

Connectivity Division updates

As of end-Mar 2025

Data centres

• Developing three AI-ready hyperscale data centres in Singapore, Taiwan

and Tokyo with Keppel’s private funds

Networks

• Bifrost awarded subsea cable landing license by the United States

Federal Communications Commission in Jan 2025

• Bifrost cable laying operations was 92% completed as of end-Mar 2025,

main trunk on track to be RFS by 2H25

• Pursuing two more cable systems with over 30 fibre pairs connecting

Southeast Asia to the rest of Asia and beyond

M1

• Higher EBITDA yoy

• Decommissioning of legacy tech stack on track to be completed in 2025

- 13.

© Keppel 13

PeriodValue ($m)

2020 1,238

2021 1,666

2022 1,515

2023 947

2024 1,525

YTD 2025 347

TOTAL 7,238

Asset Country Value ($m)

22.6% stake in Saigon Centre Phase 3 Vietnam 98

42% stake in Palm City Vietnam 141

29.52% stake in Keppel Philippines Holdings Inc Philippines 11

30% stake in Tianjin Fulong China 93

Othersi - 4

YTD 2025 347

Announced since the start of asset monetisation

programme in Oct 2020

Vision 2030 asset monetisation

i Includes non-core investments in Australia and Thailand.

- 14.

© Keppel 14

Disclaimer

NOTFOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION. THIS PRESENTATION SHALL NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION

OF AN OFFER TO SELL, SUBSCRIBE FOR OR BUY SECURITIES IN ANY JURISDICTION, INCLUDING IN THE

UNITED STATES.

This presentation is for information purposes only and does not have regard to your specific investment

objectives, financial situation or your particular needs. Any information in this presentation is not to be

construed as investment or financial advice and does not constitute an invitation, offer or solicitation of any

offer to acquire, purchase or subscribe for securities or other financial instruments in Keppel Ltd. (“Keppel”).

The past performance of Keppel is not indicative of the future performance of Keppel. You should exercise

judgment in your own financial decisions. If in doubt, please consult with your professional advisers.

Unless explicitly indicated otherwise, all monetary values denoted as ‘$’ within this presentation are to be

interpreted as referring to Singapore dollars.