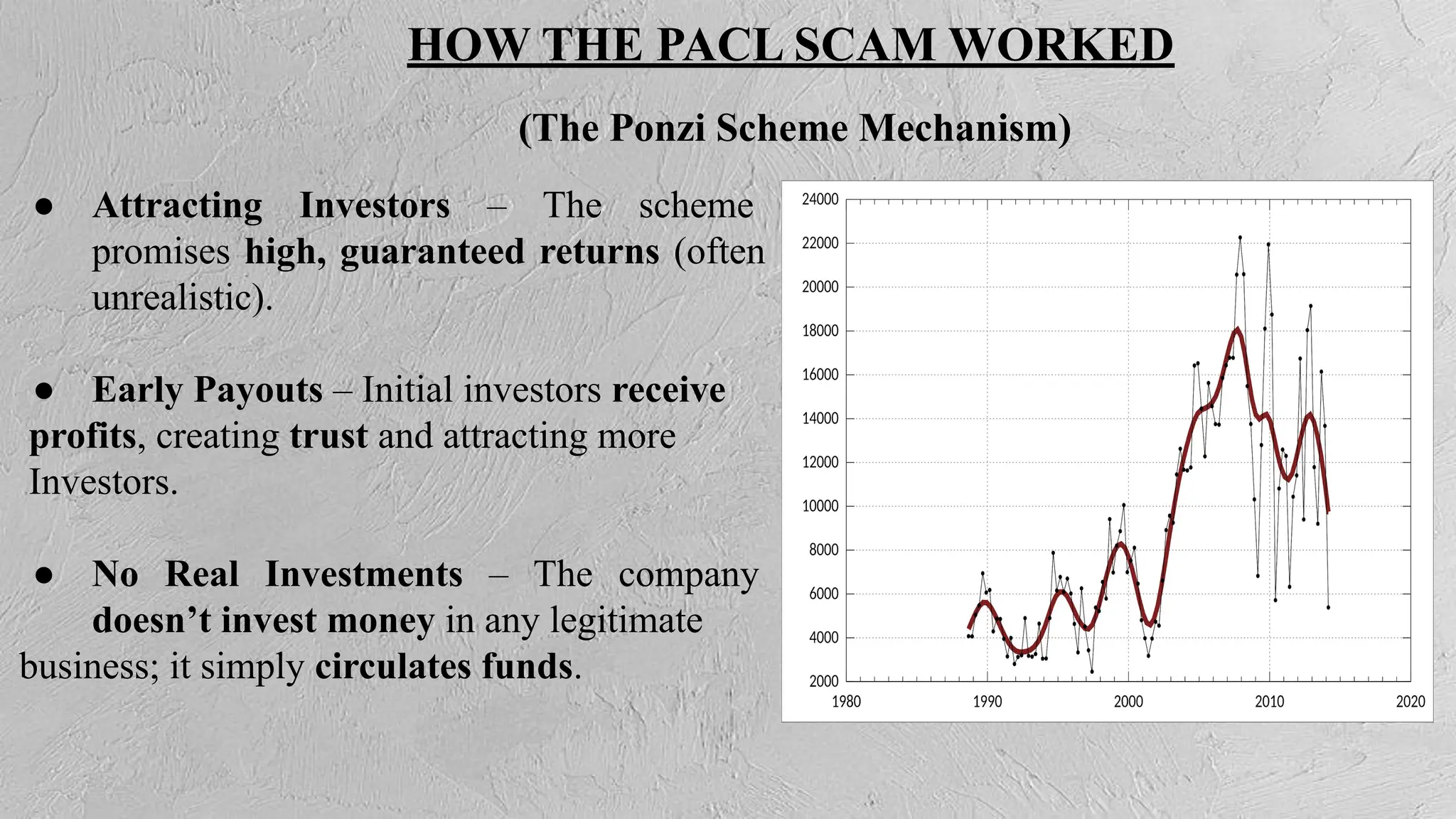

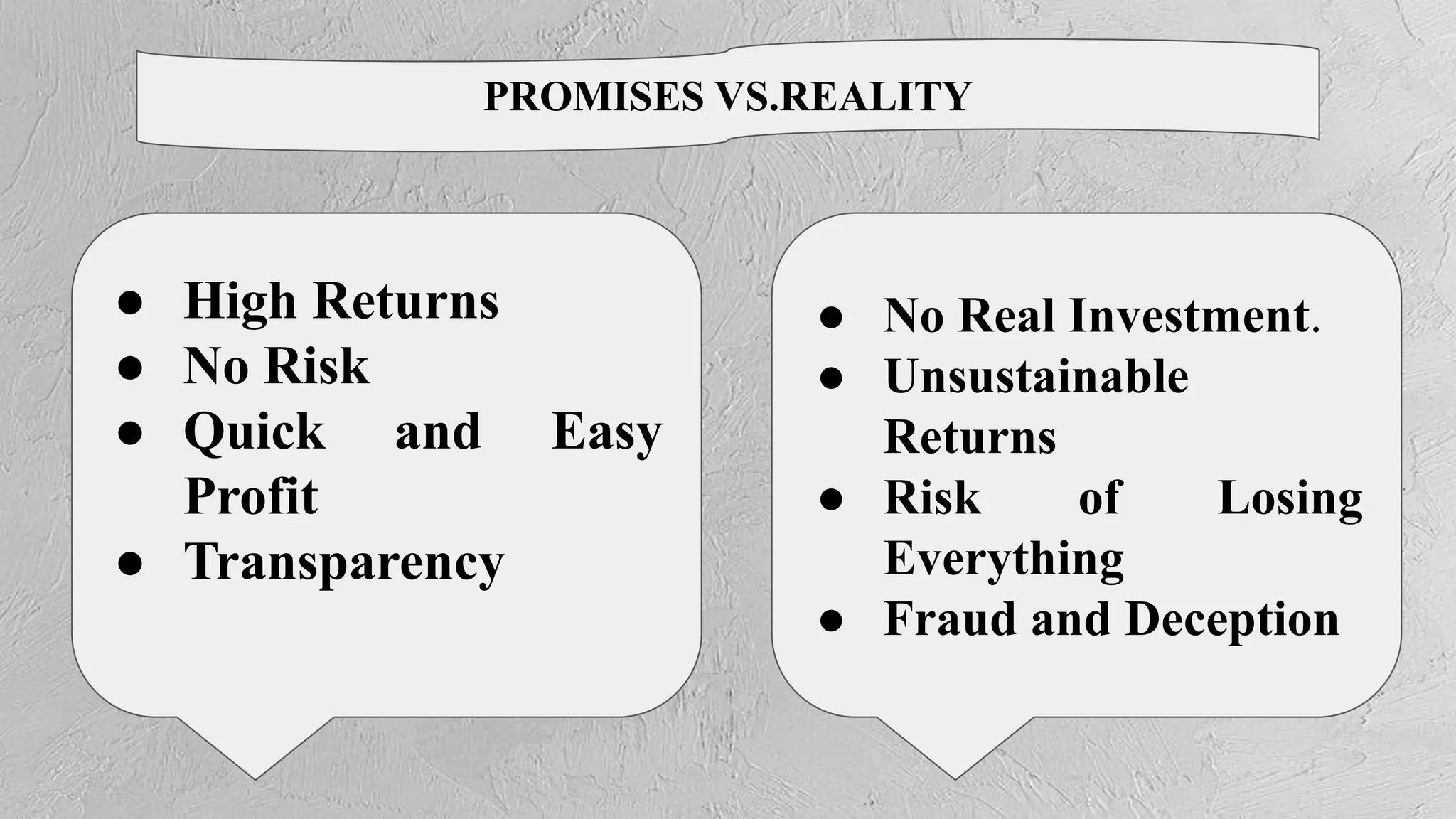

The document discusses the 1992 Indian stock market scam orchestrated by Harshad Mehta, who manipulated stock prices through fraudulent activities, resulting in a financial crisis that wiped out investor wealth and led to stricter regulations. It highlights key figures involved, including regulatory lapses and media coverage that uncovered the fraud, as well as lessons learned about the importance of transparency and investor protection. Additionally, it covers the PACL Ponzi scheme, underscoring the damage inflicted on investors and the broader economic impact of such scams.