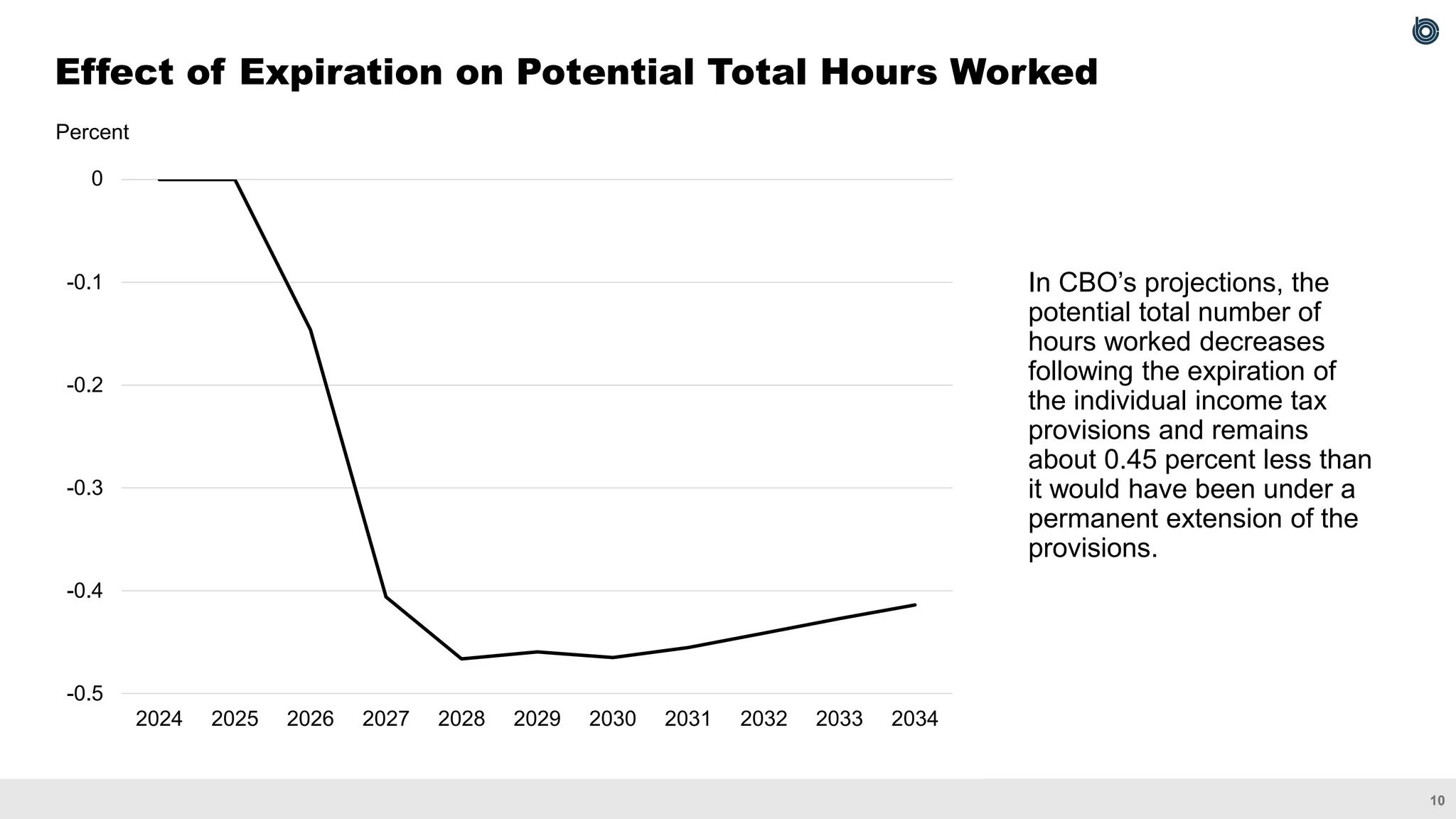

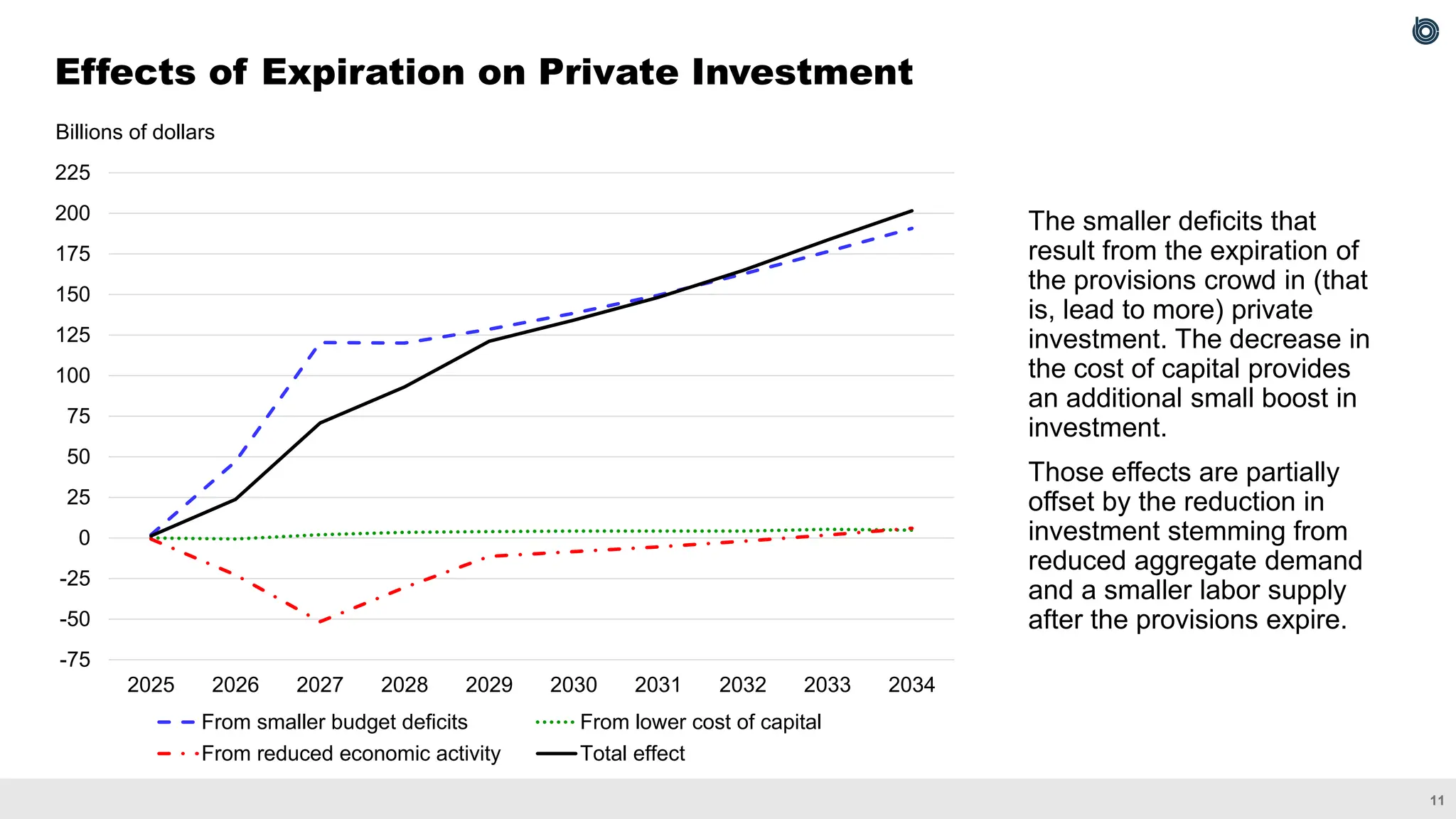

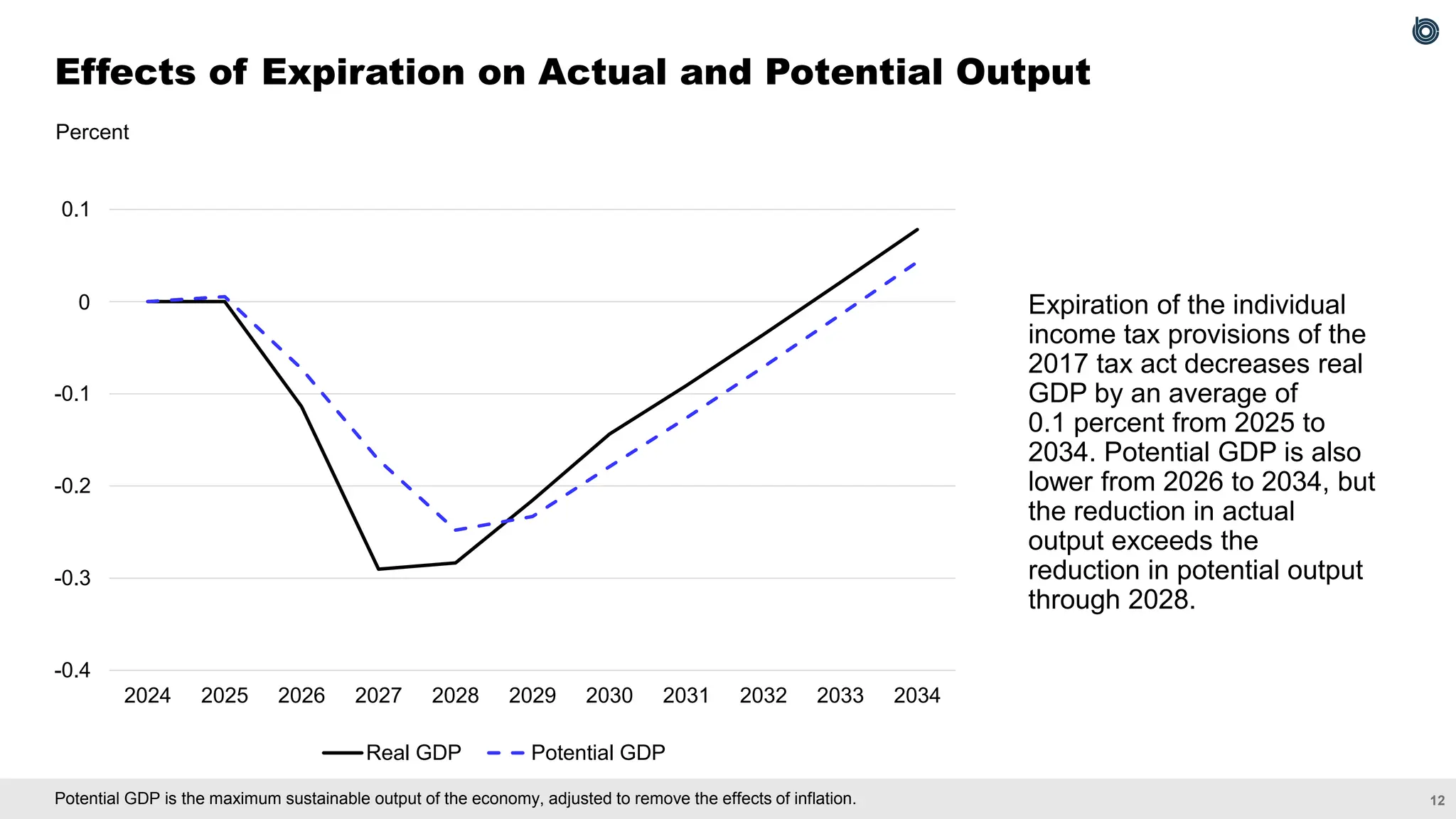

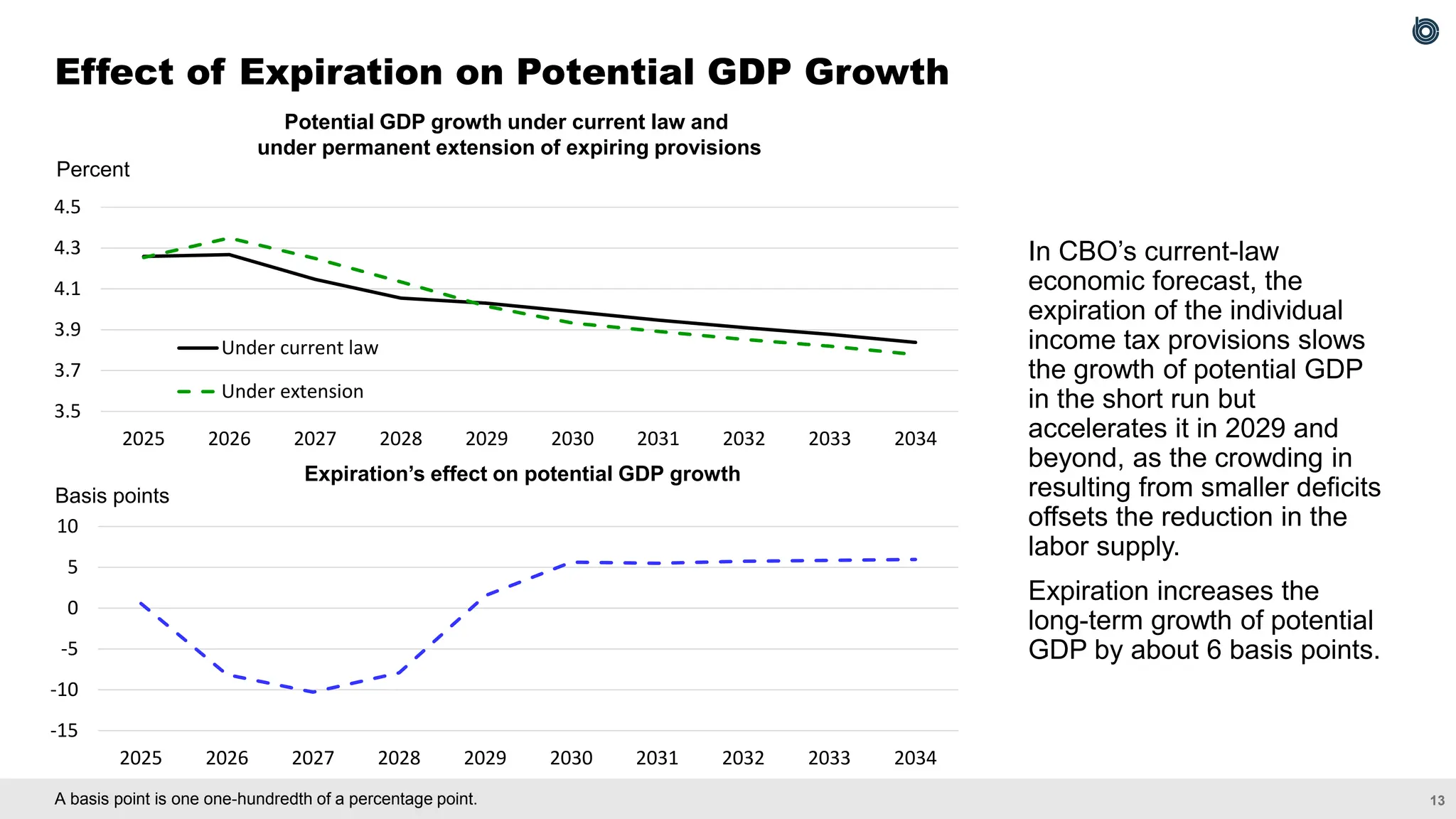

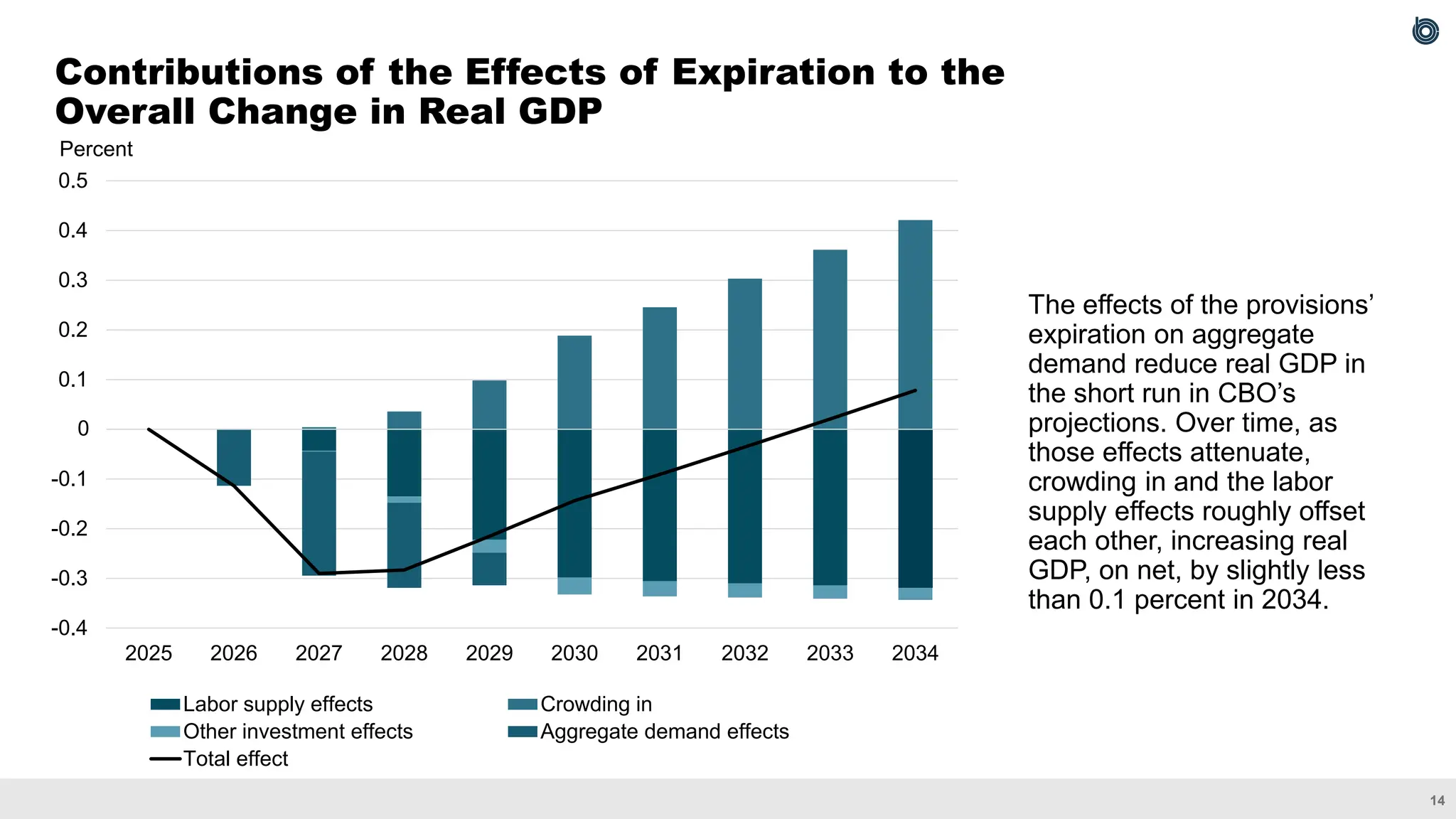

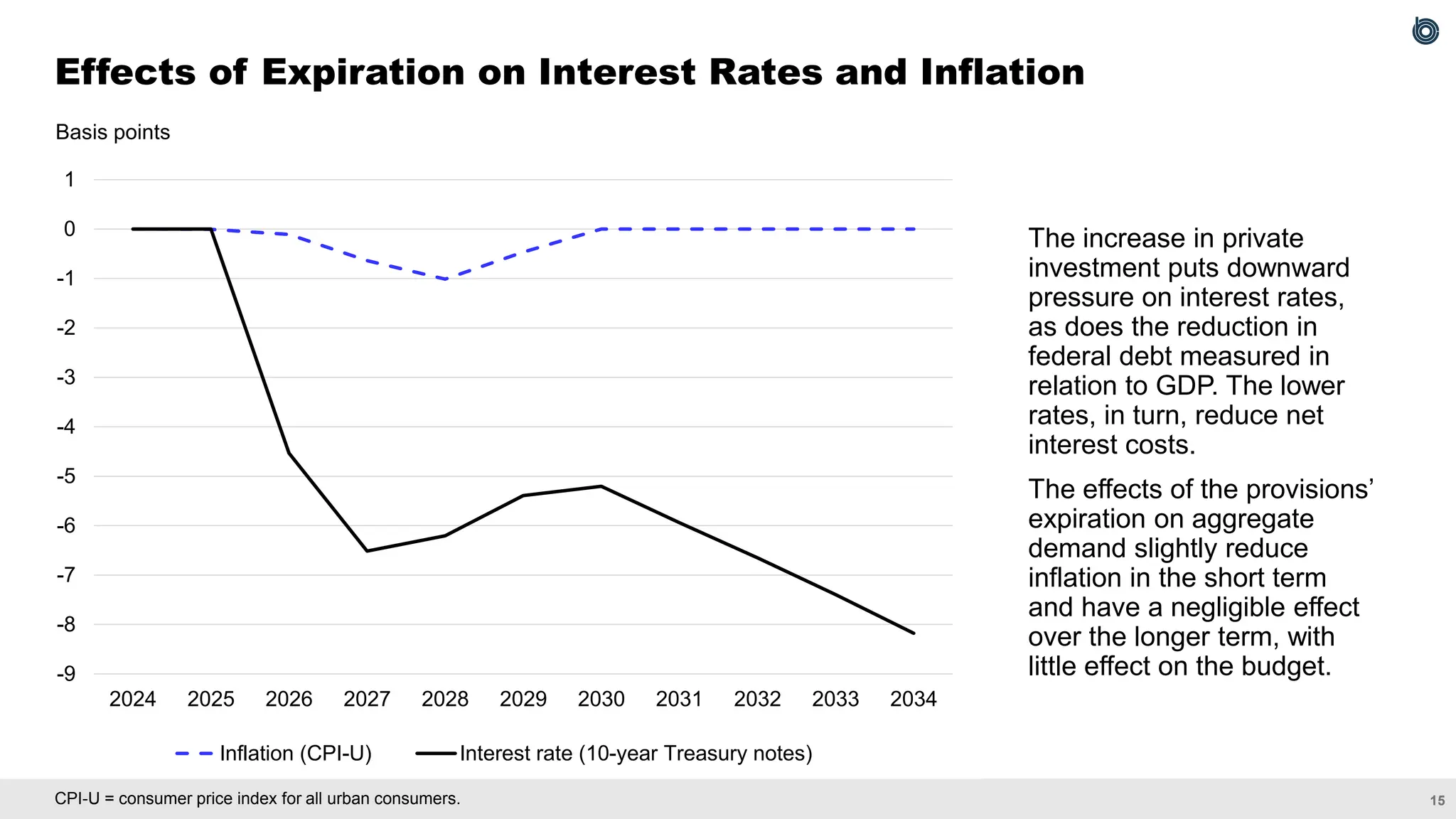

The Congressional Budget Office (CBO) analyzes the impact of expiring individual income tax provisions from the 2017 tax act on its economic forecasts, noting that these expirations, scheduled for the end of 2025, modestly reduce labor supply and lead to higher marginal tax rates. While the increase in tax revenues from the expiration reduces federal deficits and potentially encourages private investment, the net effects result in only minor changes to GDP. CBO’s projections also indicate that the expiration decreases actual GDP growth in the short term while potentially accelerating it in the long run due to reduced deficits.